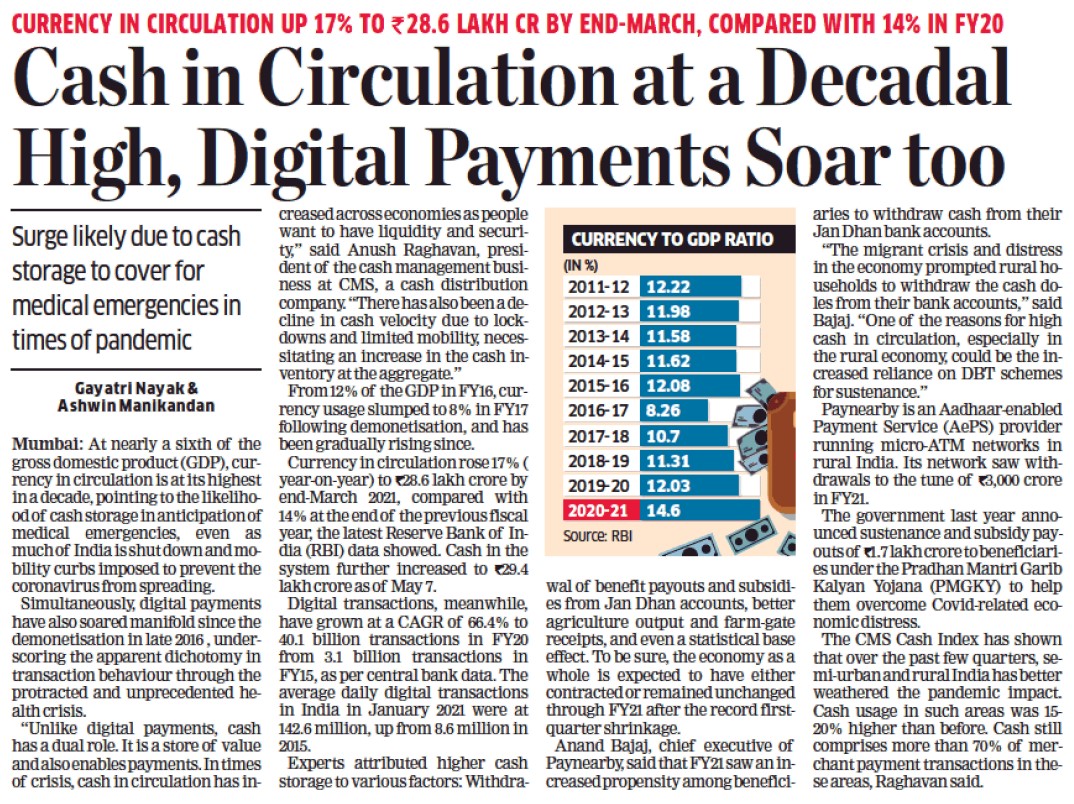

The Reserve Bank of India (RBI) on Thursday announced the launch of Digital Payments Index (DPI) to assess the level of digitalisation of payments in the country. “The DPI would be based on multiple parameters and shall reflect accurately the penetration and deepening of various digital payment modes. The DPI will be made available from July 2020 onwards,” the Reserve Bank said in its statement. Both the RBI and government have been aggressively working on enabling the adoption of the cashless payment in the form of digital mobile wallets, debit and credit cards, internet banking and UPI for some time now.

“RBI’s Digital Payment Index is a good move. It will help to map the level of digitization across the country. It will be beneficial for us to understand usage of digital channels in urban and rural areas. Banks and Payment companies will get to know which channels are more popular among consumers. The mapping of digital payments will eventually help the end consumers evolve in the space”, Mandar Agashe, Founder & Vice Chairman, Sarvatra Technologies, said.

In December 2019, Finance Minister Nirmala Sitharaman announced the exemption of Merchant Discount Rate(MDR) charges on the transactions done via UPI and RuPay modes. This was done to take the Indian economy towards a less-cash economy.

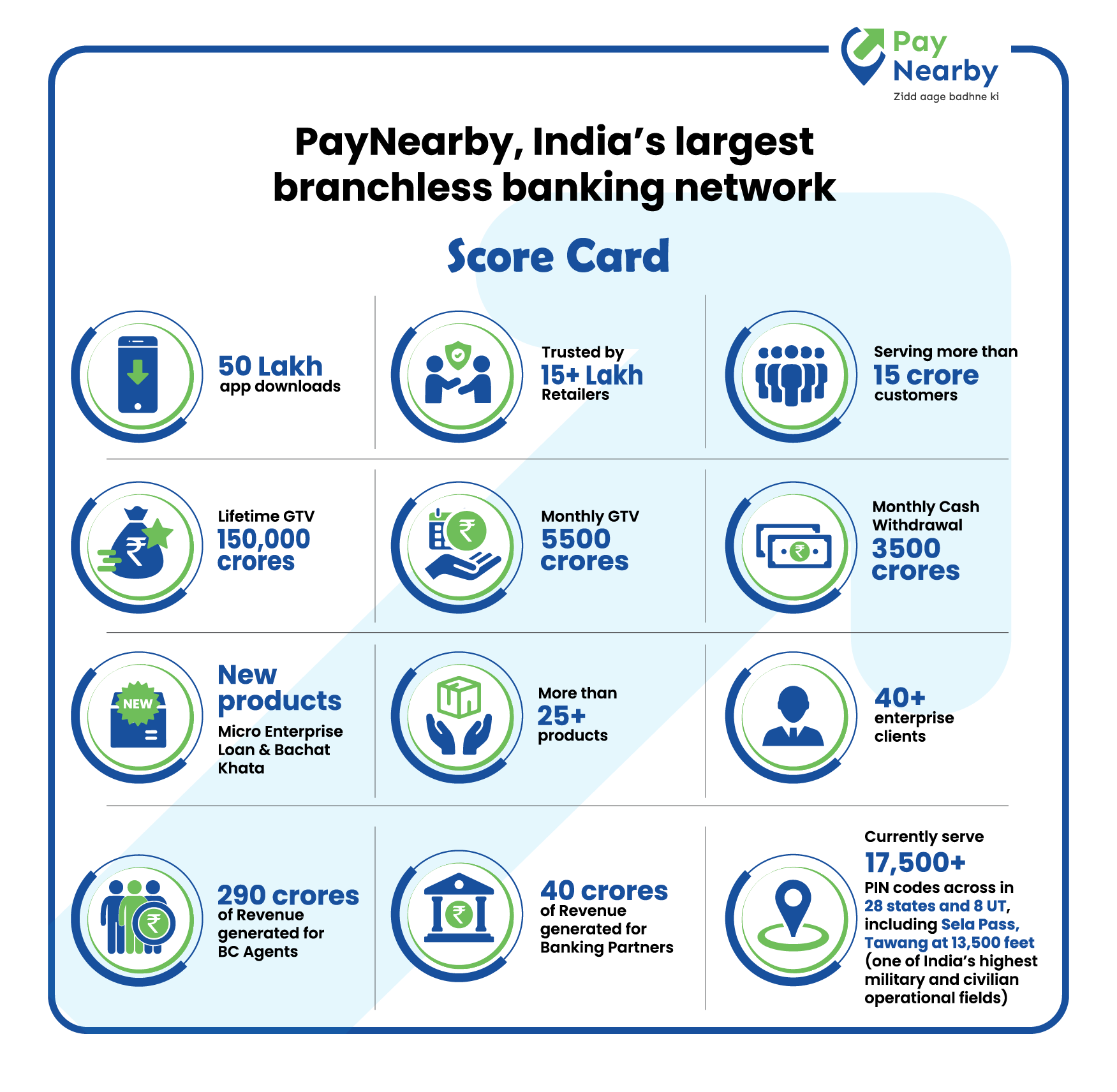

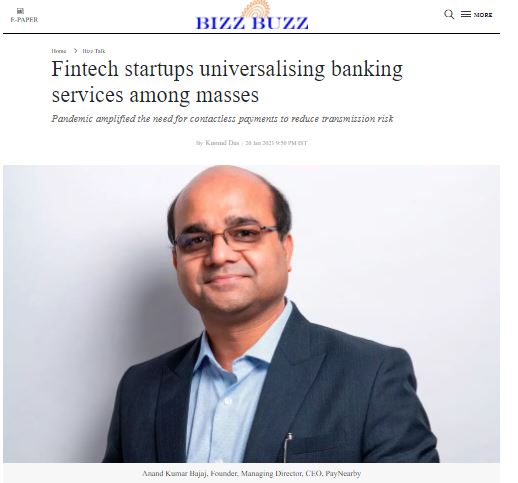

“We are delighted by the announcement of a ‘Digital Payments Index’ by the RBI. This development is indicative of the power being put by government to aggressively drive the financial inclusion agenda. A body that periodically tracks the penetration of digital payment modes serves as a yardstick, while also suggesting that the RBI is keen on measuring the sector progression, and whether it is aligned to their target goals. At an individual level, this initiative will enable companies to gauge the ground-level effectiveness of the various programs running across the country. The index will also assist the financial payments ecosystem to identify areas of growth and improvement for widespread permeation of cashless payments”, Anand Kumar Bajaj, MD & CEO, PayNearby, said.

- Source – Financial Express

- Published Date – February 6, 2020