Fintech apps are jumping at the opportunity, considering that there are about 1.2 crore kirana stores

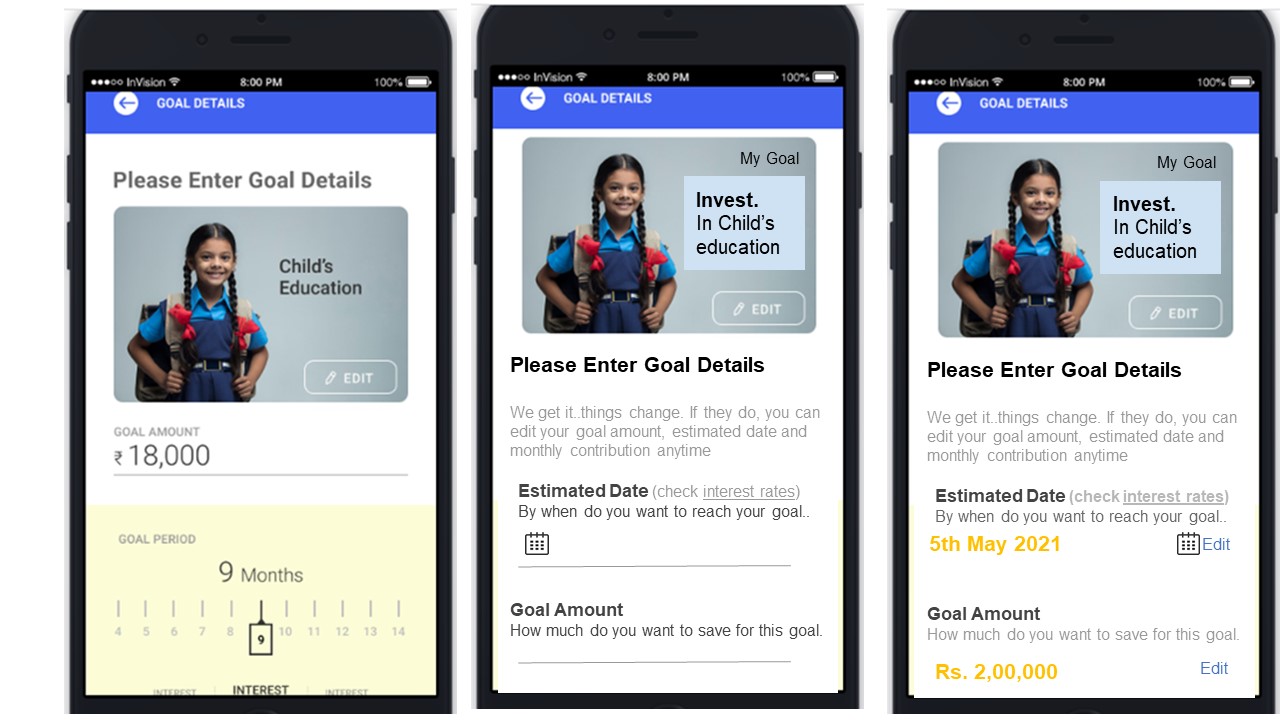

The good old neighbourhood kirana store has been attracting a lot of attention from financial technology (fintech) companies in recent times. Eyeing the huge reservoir of consumer data these stores possess, fintech companies are devising ways to make operations smoother for them — be it by launching apps or point of sale (POS) systems.

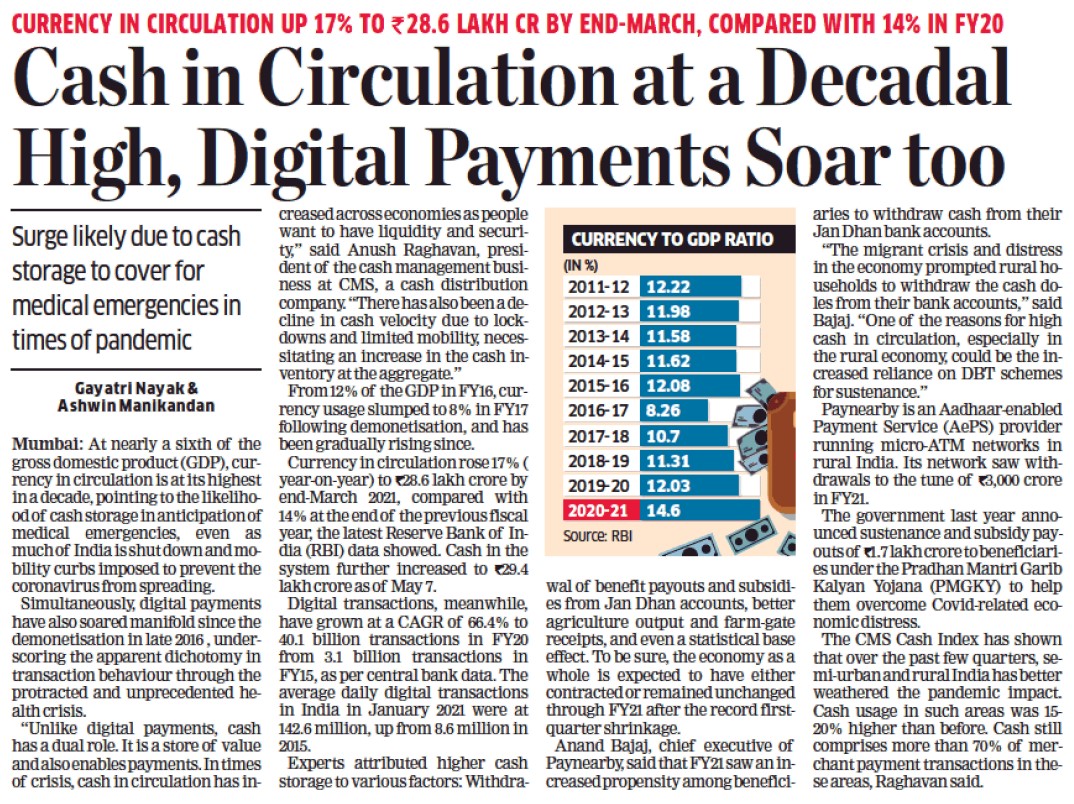

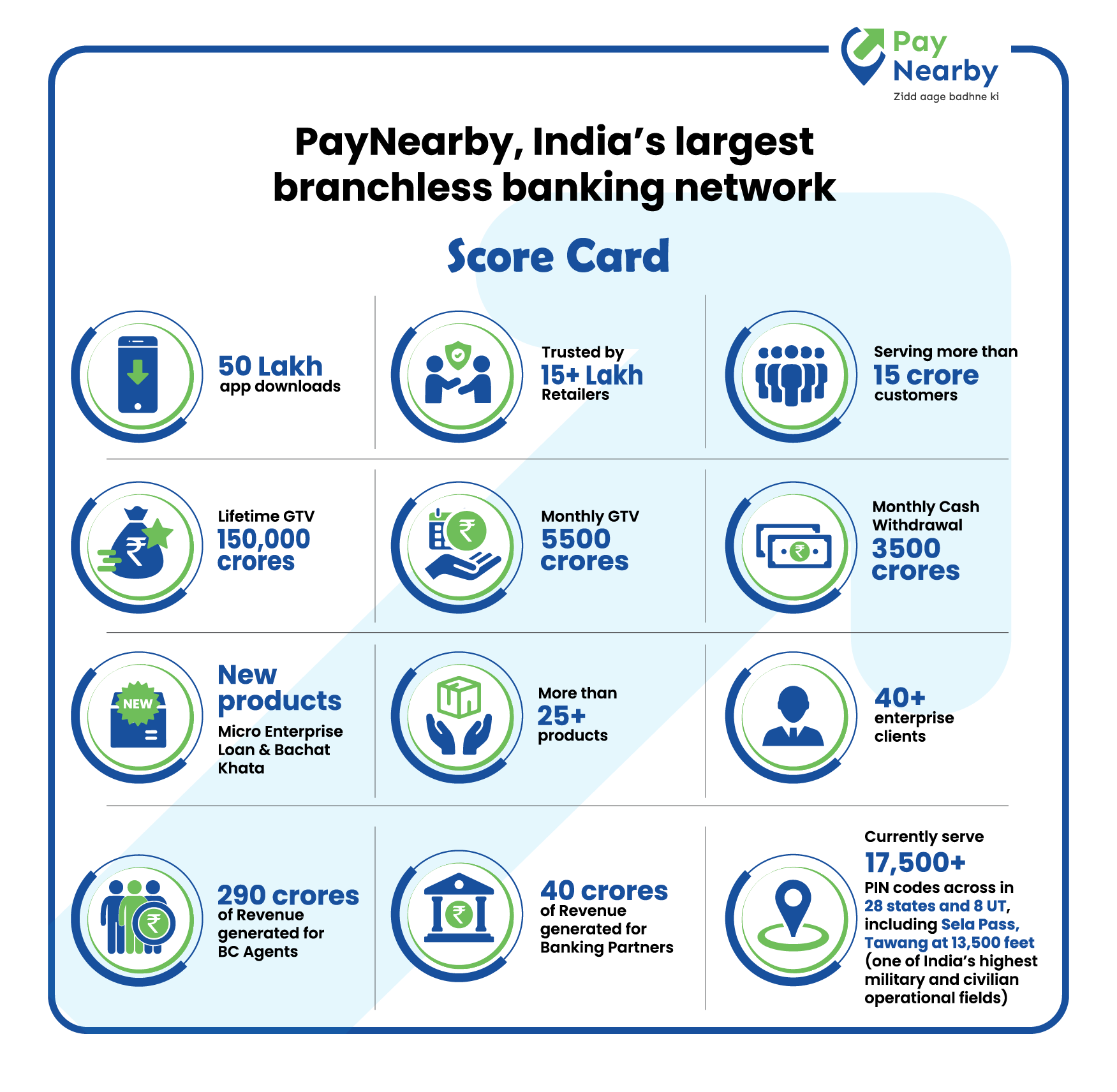

Paytm announced a Rs 100 crore loyalty programme for kirana stores in May, and had even launched an online ledger for kirana stores, called Paytm Business Khata, in January this year. Another fintech company PayNearby has rolled out a hyperlocal delivery app for general store retailers, while Pine Labs plans to launch a low-cost POS (point of sale) payment system for these store owners. Others like BharatPe, PhonePe and Mswipe have also rolled out products for small shop owners.

The biggest challenge kirana stores face, according to RedSeer Consulting’s survey conducted in December last year, is credit collection from customers, followed by difficulty in accounting or bookkeeping. These fintech apps are jumping at the opportunity, considering that there are about 1.2 crore kirana stores, which account for almost 90% of the FMCG sales in the country, as per Nielsen.

Point of scale

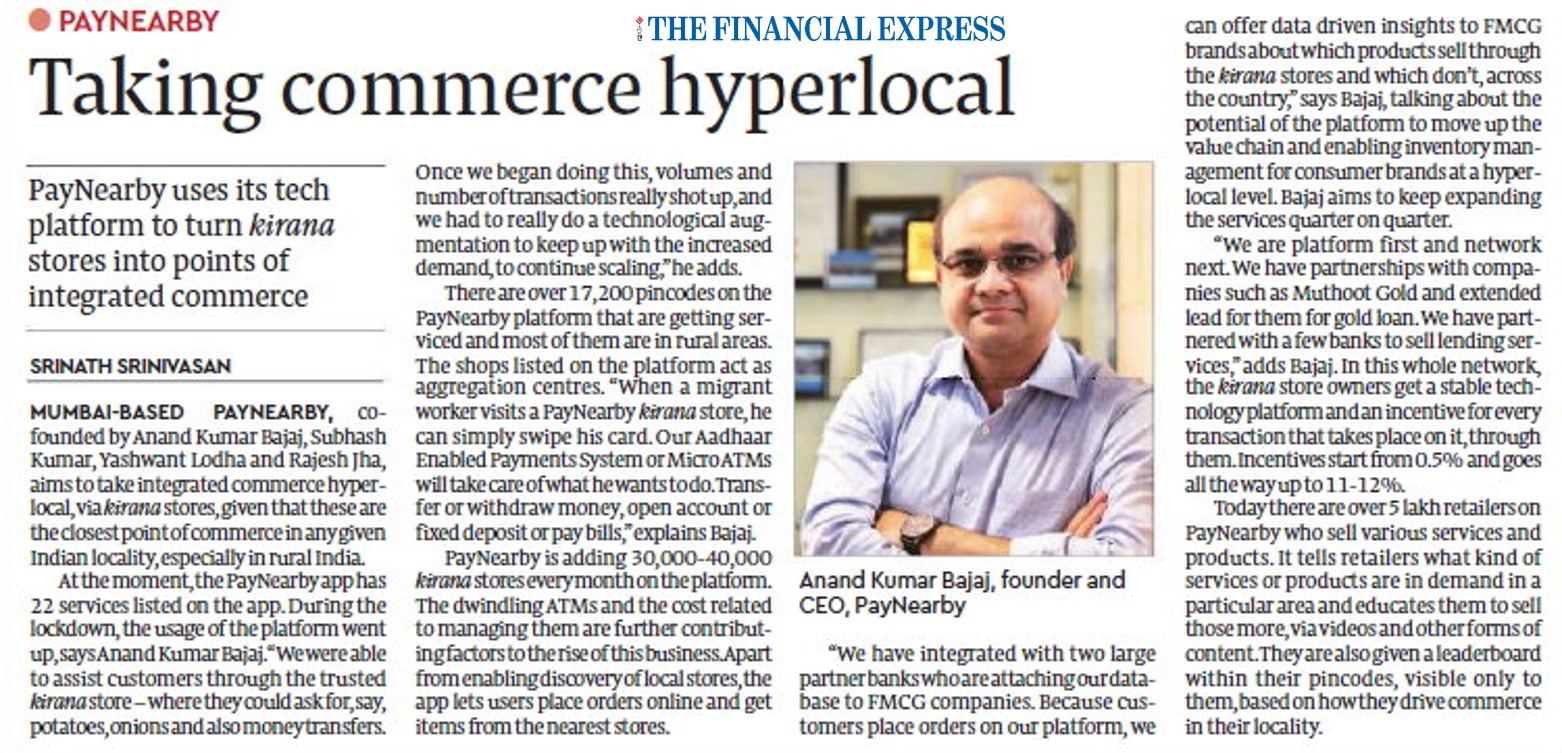

PayNearby started engaging with kirana stores back in 2016 under its Agent Banking system that enables retailers to offer services such as dispensing cash to the end consumer. It currently has tie-ups with over 8.5 lakh retailers. The company has recently launched a hyperlocal discovery app, BuyNearby.

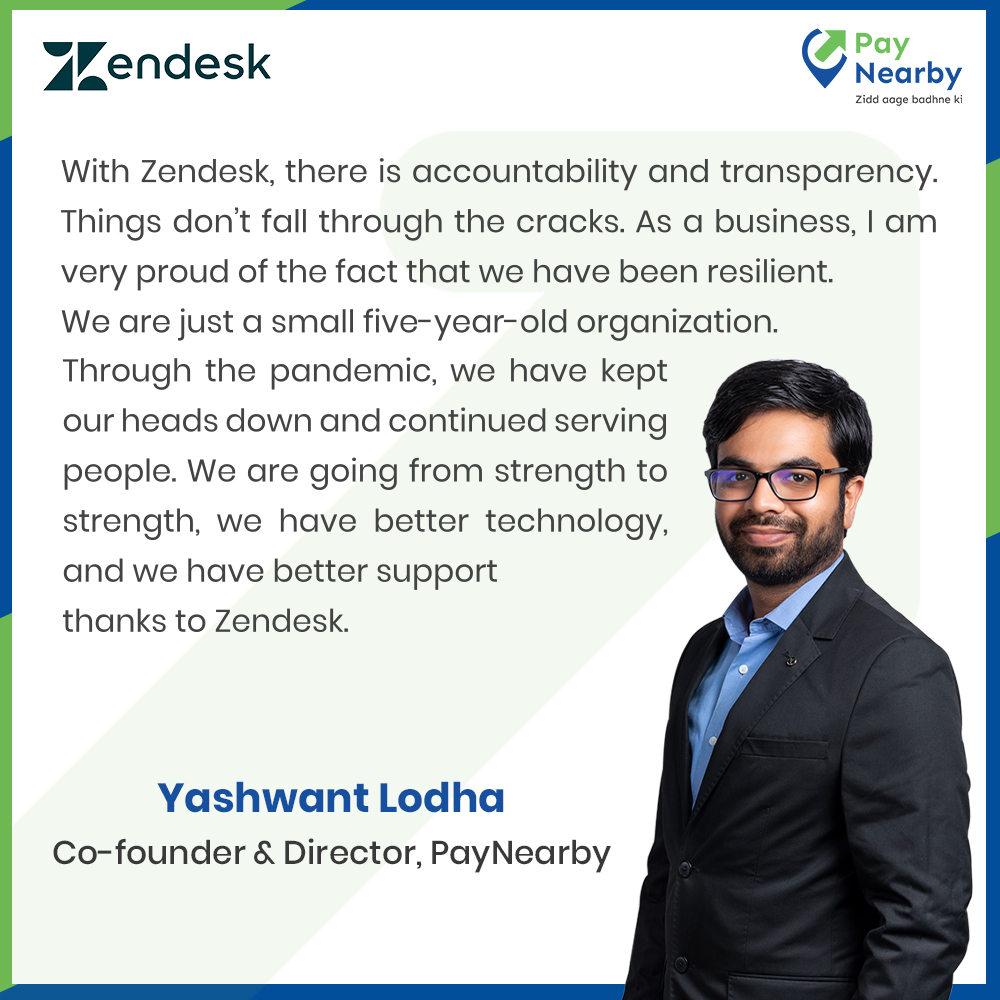

Anand Kumar Bajaj, MD and CEO, PayNearby, says, “Kiranas are important for our business, and hence, we wanted to ensure their survival in this age of e-commerce and modern trade.” Besides offering services like product discovery and digital payments to the end consumer, the app enables retailers to place bulk orders to their distributors, offers them multiple payment options and maintains a record of credit given to customers. BuyNearby has over 50,000 registered users, of which over 15,000 are active and are not being monetised.

“The app helps us enroll retailers for our agent banking programme. But we plan to monetise the data that comes our way through the app,” Bajaj adds.

Pine Labs, through its POS payment system, plans to reach one lakh retailers in the next 12 months. “Our current customers make digital transactions worth Rs 1.5-2 lakh per month, but now we are eying retailers who earn less than Rs 50,000 a month,” says Kush Mehra, chief business officer at Pine Labs. Its POS terminals will accept payment from various modes such as wallets, cards and QR codes. While the company would be monetising this platform, it is looking at offering financial products to these retailers with the help of the data collected, and also partnering with other players who offer solutions for bookkeeping, supply chain, etc.

Paytm is helping kiranas digitise and grow their businesses, “by offering them technology solutions such as an all-in-one Android POS device, all-in-one QR and Paytm Business Khata,” says a Paytm spokesperson. The company says that its all-in-one QR enables merchants to accept payments through Paytm wallet, Rupay cards and all UPI-based payment apps, into their bank accounts without any fee.

Bumpy ride

Experts say that while tie-ups with kirana stores hold potential for fintech companies, they will have to face many roadblocks along the way.

“Fintech companies will have a difficult time ensuring the loyalty of these kirana stores, given the stiff competition. In addition, direct distribution to kiranas has been built over many decades, and most FMCG companies will not be keen on giving up this direct reach to kiranas,” says Rajat Wahi, partner, Deloitte India.

According to Vivek Belgavi, partner and leader, fintech, PwC India, these companies will have to maintain high stickiness and engagement metrics to monetise. “If that is achieved, fintech companies could become the gateway to a whole suite of financial (and non-financial) products, from lending to investments and insurance,” he adds.

Foremost, however, is the kirana store owner’s willingness to comply. As Subhendu Roy, partner, consumer and retail industries, Kearney, says, there could be resistance from them in adopting new technologies and digitising their processes.

- Source – Financial Express

- Published Date – June 29, 2020