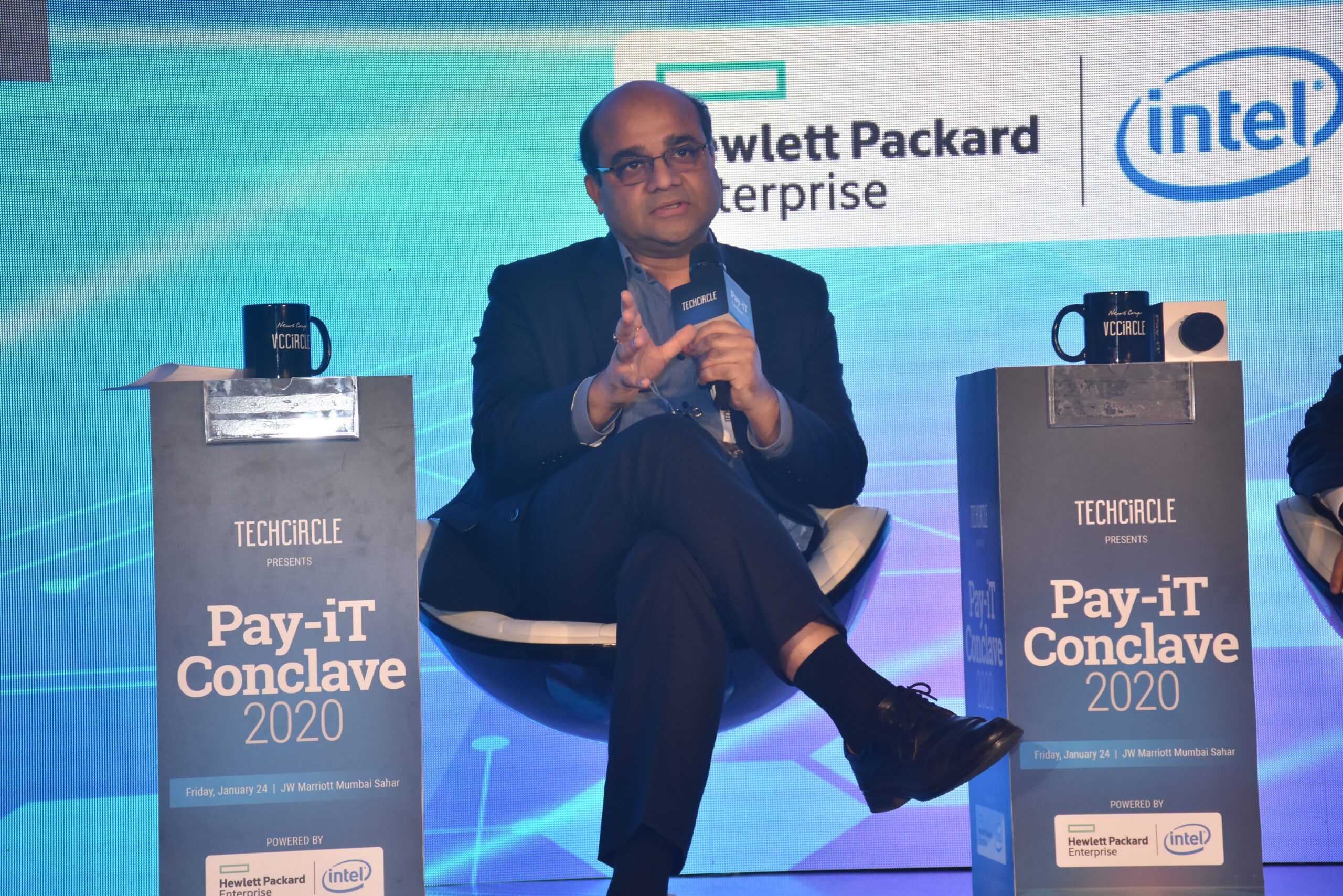

Over the years, FinTech has turned into a lucrative and innovative sector with a rising number of emerging technologies contributing to a complete shift in the financial services industry as a whole; in this interview – Anand Kumar Bajaj, MD & CEO at PayNearby discusses these changing trends while talking about fintech’s impact in Asia.

Can you tell us a little about yourself Anand? Given your time in finance/fintech – we’d love to hear about your thoughts and observations on how you are seeing this segment shape up (within the Asia-Pacific region and globally).

Growing up in a small town in Bihar, several instances made me realize how many regional areas have limited access to banking facilities or have to travel long distances for financial transactions. Those childhood experiences solidified my belief to give back to the country, and I committed myself to the vision of nation-building. Being an IIM – A alma mater and post completing my Chartered Accountancy, I began my professional journey at ICICI Bank, where, under the mentorship and guidance of Ms. Madhabi Puri Buch and Mr. Ajay Gupta, we converted my work into 5 patents. After 10 years of work at ICICI, I joined YES Bank as the Chief Innovation Officer, where I had the opportunity to work on several high-impact projects surrounding digital payments. Before leaving the bank, we built a large remittance platform for migrants and the under privileged people and subsequently created a large program for Freecharge, which became the world’s largest prepaid card program in 6 months’ time. My time at these banks imparted in me that innovation comes from collaboration, and with this intent, a few friends from the industry came together to form Nearby Technologies in 2016.

There is a lot of potential in Asia as a market for the growth of fintech. Currently, there are 62.5 ATMs per 100,000 people in Europe, but only 12.5 per 100,000 people in the APAC region, making mobile-based financial services and products extremely attractive in these countries. Fintech startups, with their adaptive, low-asset investment model are a feasible option for countries with larger populations to adopt. Fintech businesses are particularly adept at reaching “tech-literate yet financially underserved” market, and by leveraging the established banking sector, can drastically catalyse the advancement of neo-banking in these regions.

How did the idea for PayNearby come about initially and could you tell us about some key highlights from your journey so far with the startup?

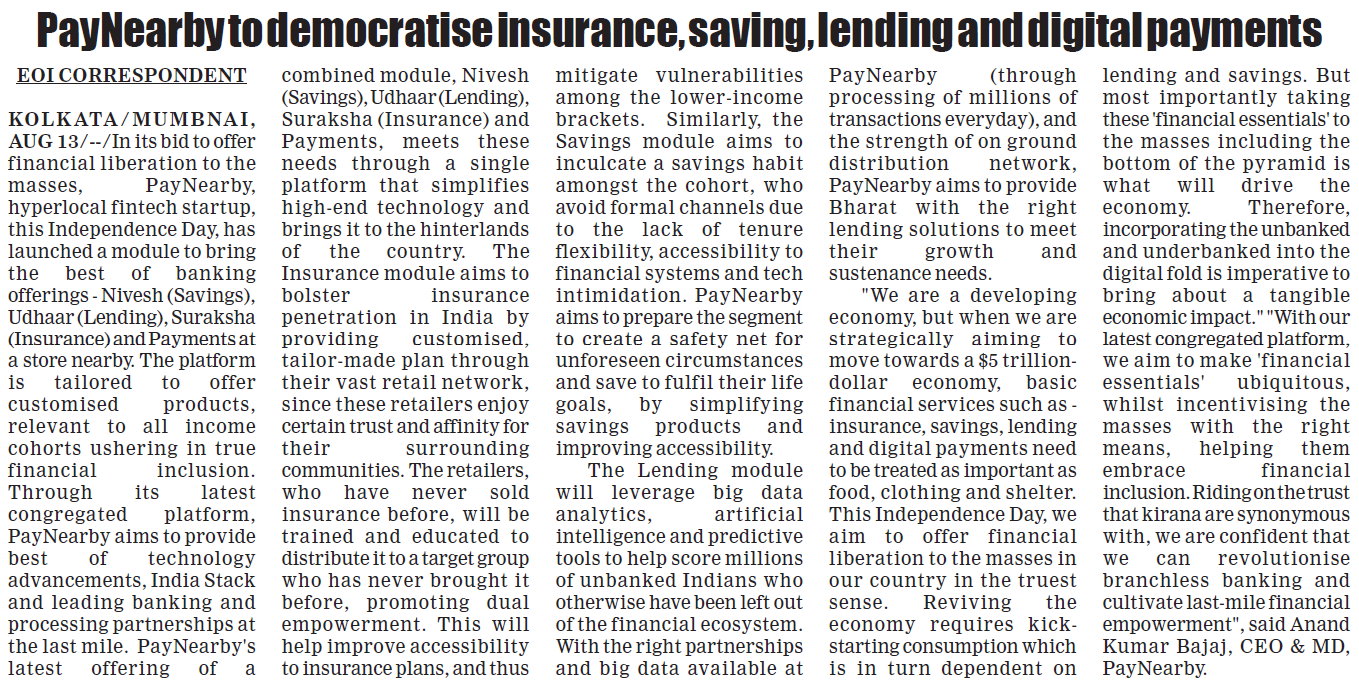

PayNearby, is the flagship brand of Nearby Technologies and was set up with a vision to bring basic banking facilities in the inroads of the country, where the real Bharat resides. Fintech innovation focused on meeting the needs of the urban 10%, thus largely ignorant of the plight of rural dwellers and how they were marginalised in the financial inclusion process.

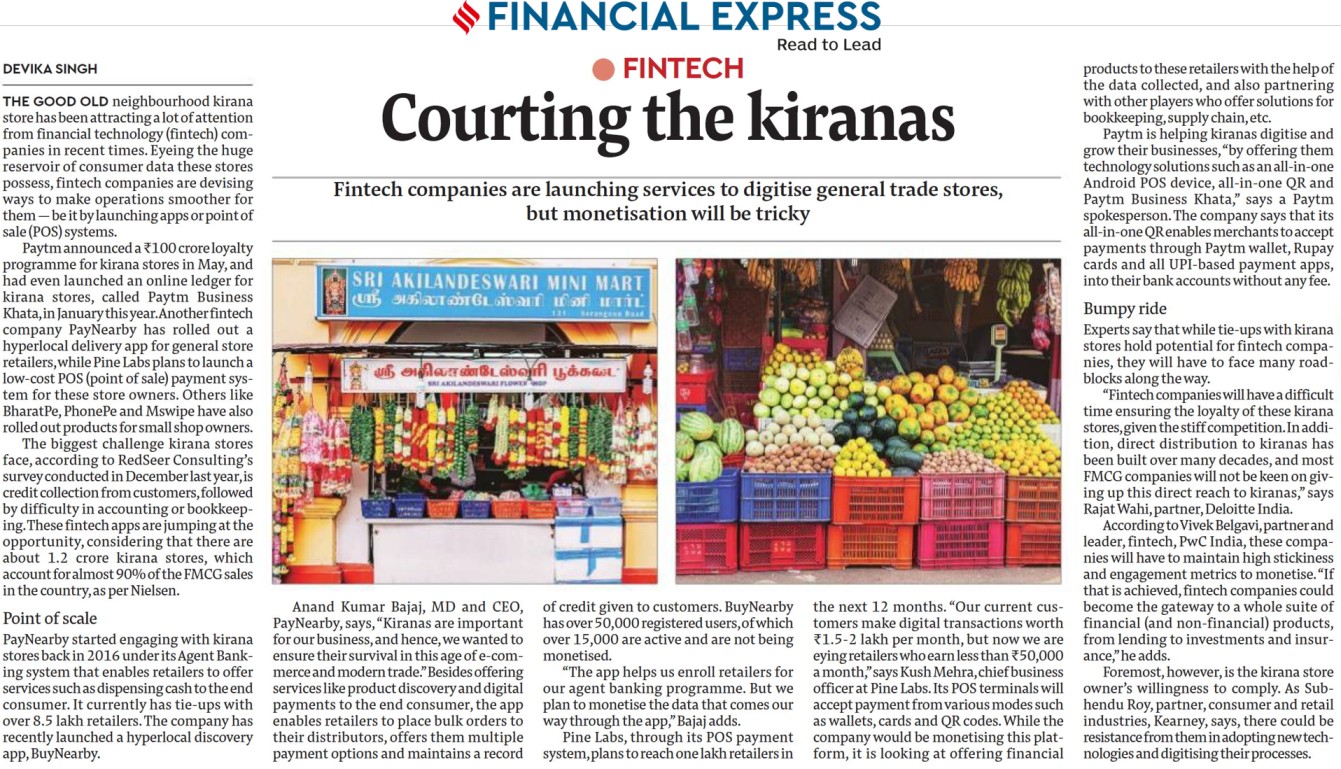

With only 3% of insurance penetration in India, only 8% have invested in mutual funds, only 22% have access to finance, we needed to sachetise existing banking services in a way that it would be accessible to people nearby, while also handholding a technology shy population to the next stage of development. The traditional kiranas always formed the heart of every community and owned inexplicable understanding for their needs. We realized collaborating with these brick and mortar stores would enable us make inroads into the pulse of the population, and leverage the unique relationship nurtured by these stores.

With this concept in mind, we formed Nearby Technologies in 2016 to uplift retailers and stand up to the challenge of propagating financial inclusion through creation of the world’s largest assisted hyperlocal agent banking platform and network. The company’s mission to make ‘Har Dukaan Digital Pradhan’ is envisaged to empower the local retailer and create a thriving eco-system for the local community. PayNearby has successfully enabled Digital Pradhans to provide many essential services to their local communities, including Aadhaar banking, bank deposits, insurance, access to government schemes and many more.

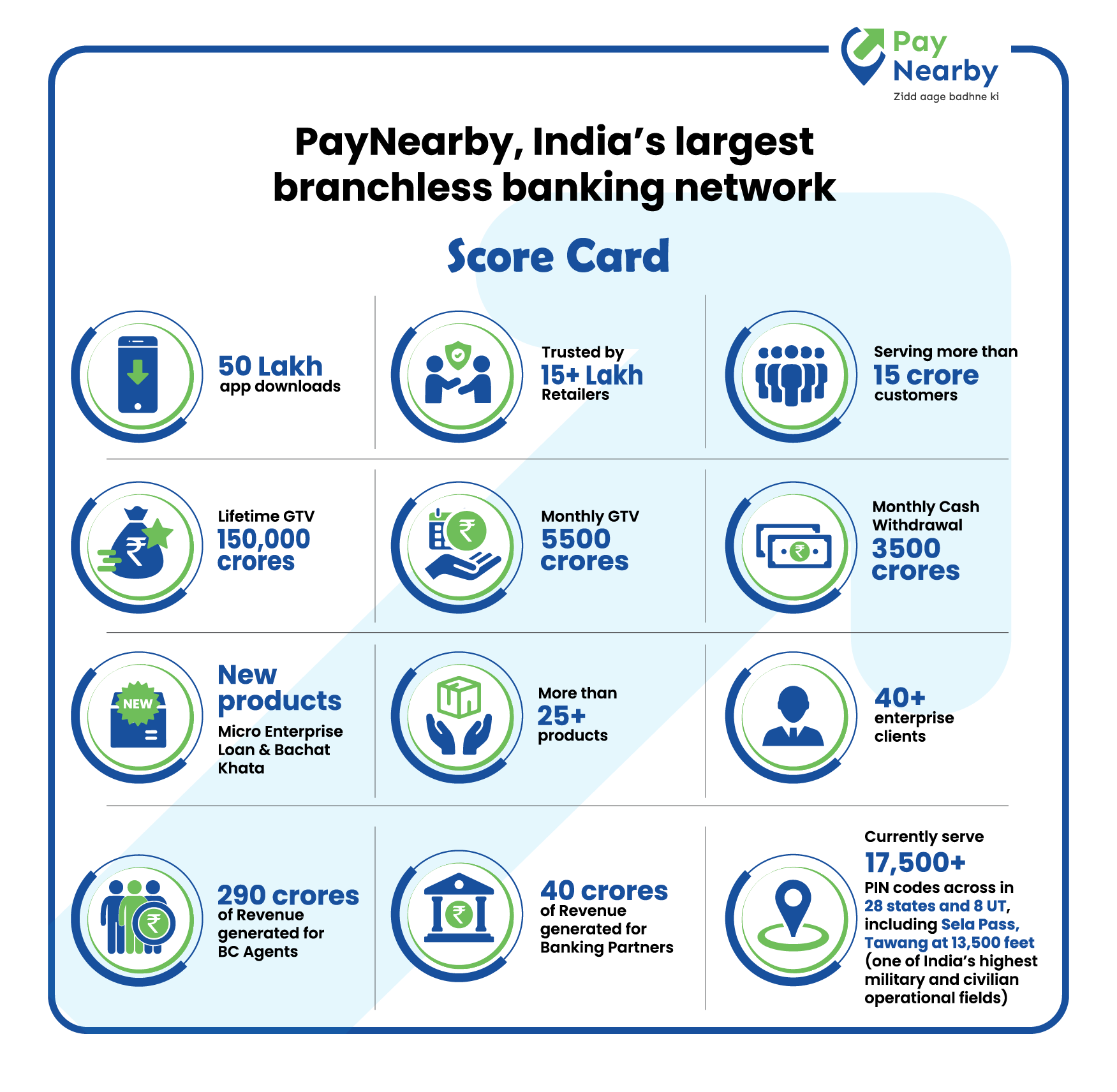

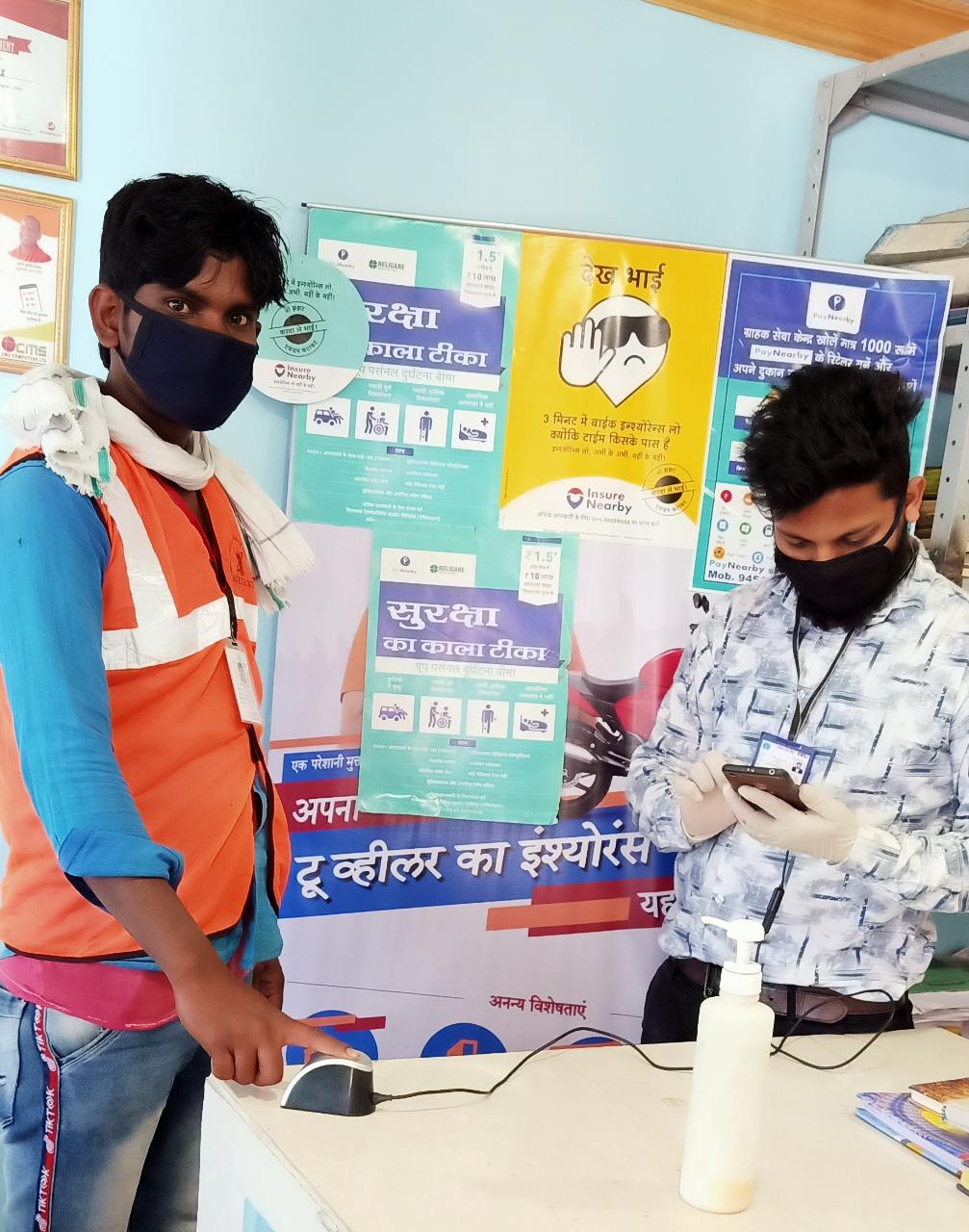

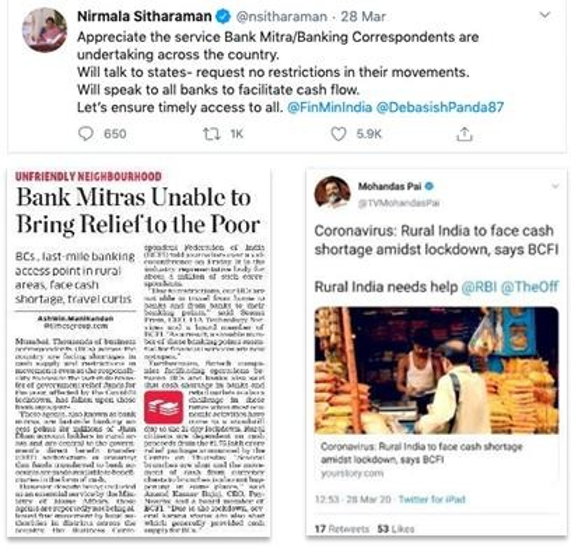

Today, PayNearby is India’s largest hyperlocal fintech network, and the largest agent banking platform in entire Southeast Asia. We service close to 10 crore Indians on a range of products and services, conducting a monthly throughput of ~4500 crore and clocking 10 lakh plus transactions on a daily basis, PayNearby is leading the segment with Aadhaar enabled Payment System (AePS), or Aadhaar banking with 33% market share. Our team of Digital Pradhans have worked tirelessly to seamlessly facilitate cash withdrawal and transfer – conducting over 7-8 lakh transactions per day during the nation-wide Covid-19 lockdown. This has been enabling the hardest hit especially the migrants and the rural population to access the Government’s DBT (Direct Benefit Transfer) disbursements with ease. Our company has enabled financial inclusion worth INR 775 crores to the consumers in 115 backward aspirational districts, identified by NITI AAYOG.

How do you see emerging tech play a key role in how newer fintech innovations are built/developed?

FinTech has evolved as one of the most innovative and cost-effective sectors. A number of emerging technologies have reshaped the financial services industry through innovation while catering to evolving customer expectations offering personalisation and convenience. Brands are now actively moving towards hyper personalisation to speak to the consumer and build brand recall. Emerging technologies are imbibing artificial intelligence and machine learning on a large scale, which is transforming day to day business.

Banks and fintechs that handle large amounts of big data are increasingly moving to cloud-based platforms and blockchain to universalise access to information. With the growth of technology and ever-changing demands of financial markets, the changes are inevitable. Each year transforms fintech in a new way. Artificial Intelligence, Internet of Things, Machine Learning with blockchain and conversational banking will all play a crucial role in attracting customers and increasing the efficiency of the financial institutions going forward.

We’d love to know how PayNearby is enabling better payments. What are your thoughts when it comes to the future of payment platforms and lending apps – what are some of the ways this space will change/what are the in-demand features that will drive growth here?

At PayNearby, we understand that trust and seamless continuity are the crux of finance, and are constantly evolving to meet the needs of our consumers to give them the best, most hassle-free experience. Our agile and judicious use of technology has allowed us to grow our business in a short amount of time; with our PAN India network spreading over 17,200 PIN codes in less than four years. Currently, the company is well positioned to meet its aggressive goals to ramp up and extend assisted hyperlocal services in the county – and upgrade its network from 8,50,000 retailers to 50,00,000 retailers in the near future.

During the lockdown, our network not only facilitated DBT in rural areas, but our banking correspondents ensured that transactions continued undisrupted even in afflicted urban areas and medical stores through our AePS platform. We have also recently expanded our hyper local discovery and purchase application ‘BuyNearby’ for PAN India operations with IndusInd Bank as digital payment partner. BuyNearby, is an e-commerce platform for kirana stores which lets consumers identify the nearest local stores around them and order online. In the wake of the lockdown, which has mandated restricted movement, providing essentials is crucial, and that is what we have always strived to do – make lives easier. The current scenario is definitely challenging, and has served as a learning curve for most businesses. Technology has been the cornerstone and foundation of innovation for most sectors and we at PayNearby aim to bring the top-end technologies to the bottom of the pyramid.

Going forward, collaboration between banks and fintech is the key to future growth future. Merging the legacy of traditional financial institutions and the agility of fintechs will maximise operational efficiency while exploring new growth avenues. Open banking too, a fairly nascent concept yet, will hit its stride post-Covid-19. The pandemic has brought about drastic behavioural shifts in terms of how we transact and consume, which will lay further emphasis on everything digital.

Can you also share your thoughts on other (global) finance technologies in the marketplace that are game changers when it comes to payments facilities?

The payment industry has seen significant adoption and innovation and is in an exponential growth trajectory. Globally many countries are keeping a close watch on the payment technology and looking to implement similar payments features.

Given the current world situation, what would your top tips be to B2B/Global tech/Fintech (product) companies to secure their transactions and prevent fraud during this time, given how a rise in cybercrime cases have been a recent cause of concern because of increase in digital banking and related security threats due to Covid19.

Integration of technology is growing and transforming every aspect of businesses globally, bringing out solutions that simplify and solve existing problems. With the ongoing pandemic, huge data migration has taken place from one system to another, and many have shifted data to cloud based storage solutions. The basics of security and implementing latest solutions to protect our systems and data is a must due to the large risks associated with such activities. Organizations must take proactive steps by advising and training their staff and customers to be more vigilant and cautious especially when opening links, emails or documents related to the subject COVID-19. B2B and fintech companies handling sensitive information like financial transactions need to adjust their threat detection mechanisms and response approaches to address new threats to networks and endpoints, as the shift to remote working has created a new set of challenges.

What are some of your thoughts on how the current world situation (the Covid19 situation) will impact the use of (and development) of the fintech segment?

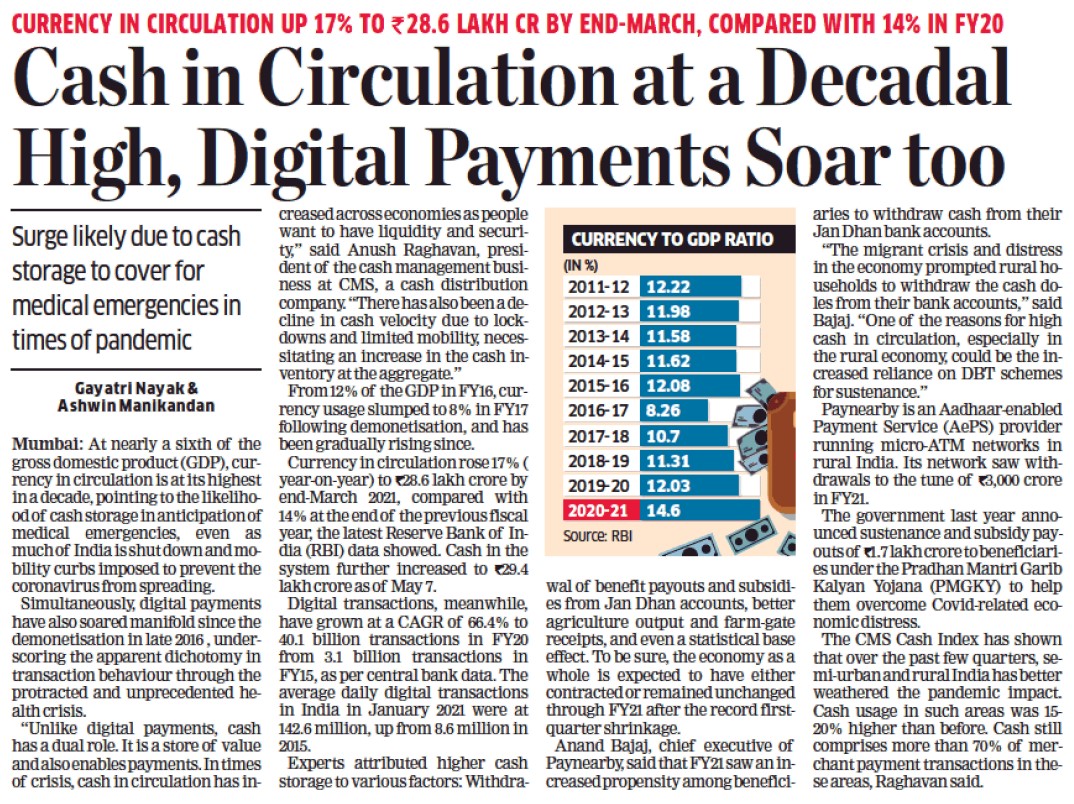

The current pandemic is likely to drive deeper relationships between incumbent banks and startups for a more digitally empowered future. With the world’s largest and the most stringent lockdown in action, home quarantining more than 1.3 billion has interestingly brought surge in ‘digital’, including – withdrawal of money, digital payments, OTT, online gaming, e-commerce and e-education among others. Many from rural India who never used digital platforms in their life time used AePS to withdraw money from their account. It is an optimal time to leverage this period, and push phygital as a fintech model which is sure to go a long way for a country like India with its fragmented population.

‘Social distancing’ being the new norm, may serve to be the latest accelerator for digitisation. With demand for digital financial services on the rise, many fintech businesses are now planning to aggressively grow their customer base besides exploring new product offerings and growth avenues. Fintech as an industry has been a force of innovation during this time. The industry is now better geared towards collaboration – using innovative tools and technologies in creating lasting partnerships with others in the sector. Going forward too, fintechs will now be able to serve customers that are usually excluded by the traditional banks due to lack of collateral or other factors.

Tag (mention/write about) the one person in the (global/international) fintech industry whose answers to these questions you would love to read!

Bret King, CEO of Moven, a New York-based mobile banking startup and Cris Skinner, an influential, independent commentator on financial markets,

Your favorite FinanceTech quote

Bringing Hi-Tech to the Bottom of the Pyramid for the customers.

Would you like to share specific finance or business tips for Marketing and Sales teams struggling through this uncertain time?

Repurposing and re-skilling are the need of the hour. It is important to remain sensitive to consumer needs and keep up with their evolving psyche. With more people staying in, and browsing websites, it would be prudent to refocus marketing tactics on online platforms to increase brand visibility and recall.

- Source – Global Fintech Series

- Published Date – August 10, 2020