- Severe cash crunch in rural India with just 25,000 ATMs across 6.5 lakh villages

- Ensure unrestricted cash flow to BCs’ to ensure effective servicing

- Enable ‘Business Correspondent’ (BC) network to offer essential financial services seamlessly

- Relief incentive worth 5k for 3 months to BCs’ as a stimulus

- Better cooperation from local authorities and police department, so that BCs on ground can carry out their duties, without getting harassed during transit or at shop

The Business Correspondent Federation of India (BCFI), a body representing fintech companies today called for action as they discussed challenges and key measures to offer India a robust infrastructure to access essential financial services in the wake of the Covid-19 lockdown. The body primarily discussed the challenge of cash crunch the nation was facing especially in rural India.

On the eve of 25th March 2020, honorable PM imposed a nationwide lockdown with effect from midnight for a period of 21 days. The new stay-at-home rule resulted in not just panicked grocery orders it also rendered a big question mark on access to essential financial services. The situation is even worse in rural India with limited access to primary banking services such as – cash withdrawal, money transfer etc.

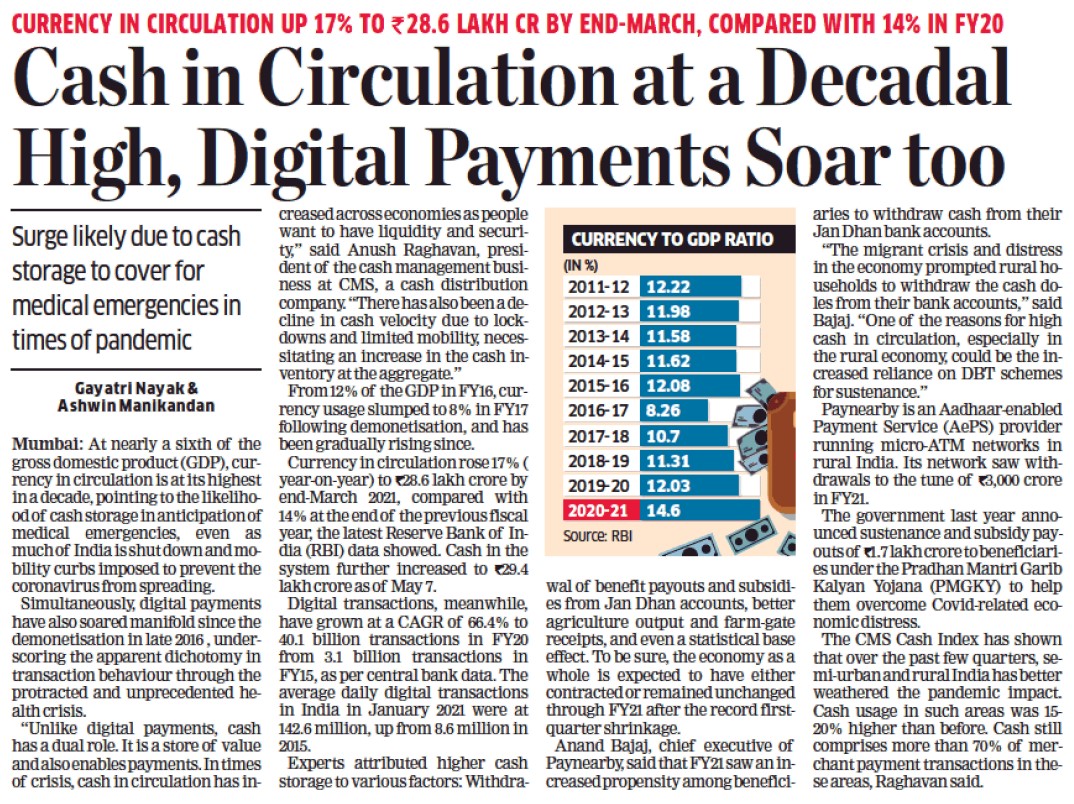

In India more than 70% population reside in rural areas representing the real Bharat. However only 5% of rural India which is 30k of the 6.5 lakh villages have access to ATMs. This poses a huge threat to easy access to essential financial services during the lockdown.

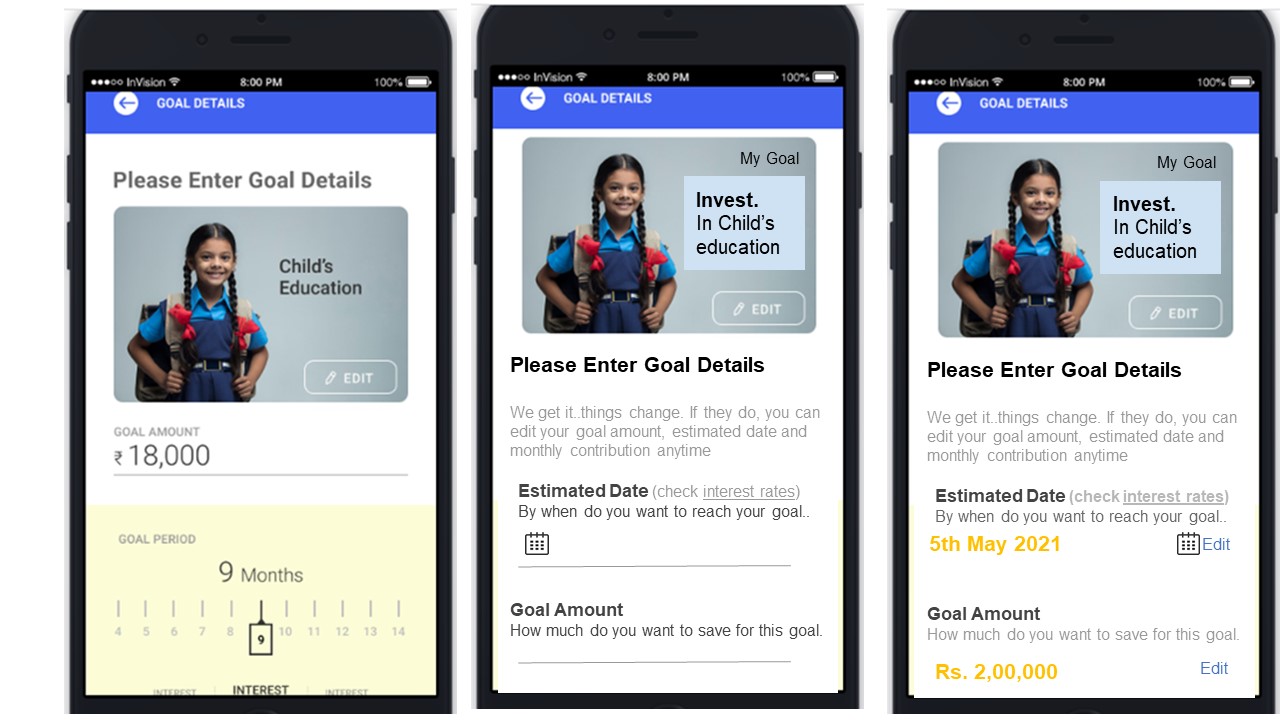

Honorable Finance Minister Nirmala Sitharam announced a relief of 1.7 lakh crore relief package for the economically weaker sections of the society. However, ensuring this package reaches the beneficiaries and they are able to access this relief cash is a huge concern in the current scenario. The digital press meet discussed the progression of how business correspondents can help the rural population get access to this money where digital infrastructure like ATMs are scarce, and the measures that can be taken to provide easy access to essential financial services in these circumstances.

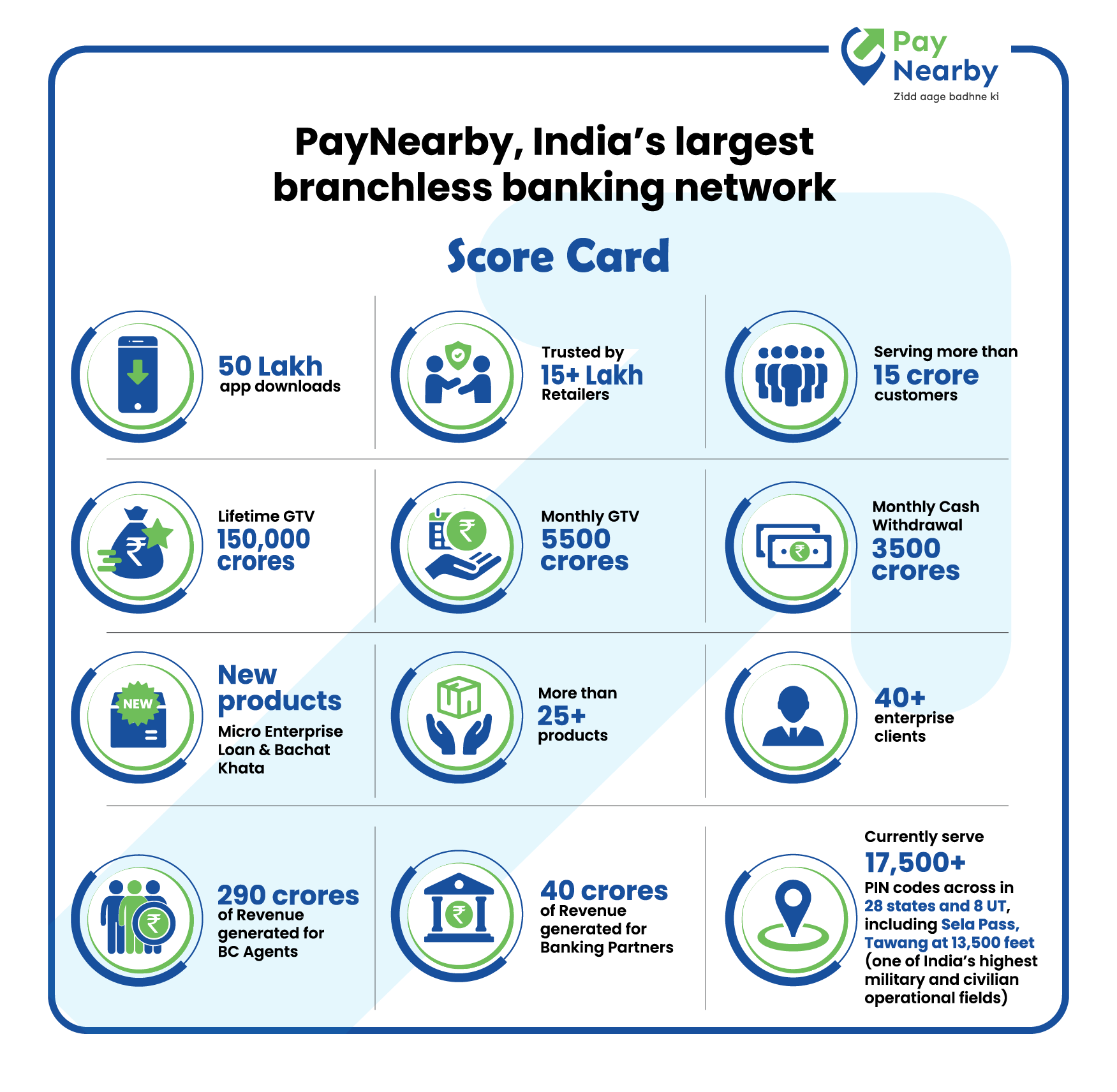

Spread across more than 17,000 PIN codes in India, through more than 10 lakh+ retail shops, BC Agents (retails outlets such as kirana stores, medical stores etc.) are the lifeline ensuring the common man has access to basic banking services such as cash deposit or cash withdrawal during this hour of need. This is truer in rural India, and the interiors of urban centre, where the Agent Banking outlets are the only point of access for people to access their money and other immediate financial needs. However, the BCs’ are currently facing a huge cash crunch which is acting as headwind in their ability to serve as an active cash disbursal point. Also, there are sometimes considerable challenges that these agents are facing from local authorities and police, either during transit or while operating their shops.

BCFI has appealed to banks and other stakeholders in the ecosystem to help agents have safe and easy access to cash from their local banks, so that they can continue unhindered providing essential services to the common man. Also, the federation has requested for more cooperation and support from local authorities in helping these foot soldiers play their part in this hour of need. BCFI also would like to appeal to the government for a relief package of Rs. 5000 for the next three months, which is less than 0.5% of the 1.75 lakh crore package announced to motivate the BC eco-system to offer uninterrupted services and ensure the benefits of the relief package reach the intended and they can access the cash.

The media was addressed by :

- Sasidhar Thumuluri, MD & CEO – Basix Sub-K Itransactions Limited | Chairman BCFI

- Ms Seema Prem, FIA Technologoy Services

- Amit Jain, Chief – Business Operations – Fino Payments Bank | Board Member BCFI

- Sunil Kulkarni, Chief Business Mentor – Oxigen Services India Private Limited | Board Member BCFI

- Mr Vijay Pratap Singh Aditya, CEO, Ekagon Technologies

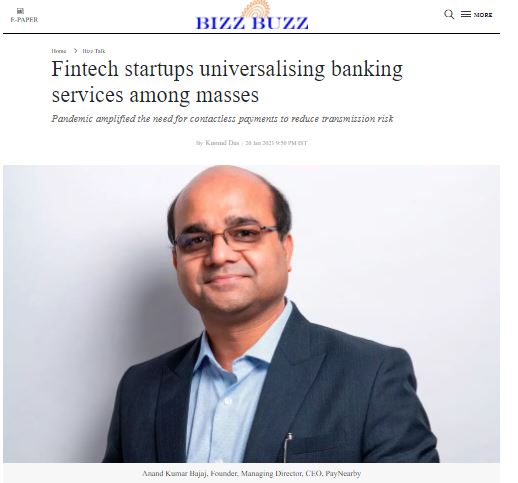

- Anand Kumar Bajaj, MD & CEO – PayNearby | Board Member BCFI

Speaking at the press meet, one of the spokesperson from the federation said, “In these seriously challenging times, to ensure that that the relief package reaches the intended, and beneficiaries are able to access the cash, along with the banking systems, our banking mitras or Business Correspondents are the frontline warriors, who are braving the situation in every nook and corner of the country, especially in rural areas and urban interiors, so that people can access this relief cash.

Most of India’s population lives in villages, and while we are extremely grateful for the government’s prompt response towards relief measures, it is imperative that there is a robust network in place, both digital and assisted, to allow the beneficiaries to avail them. The existing geographical challenges which have aggravated further in the wake of the pandemic has impeded accessibility to financial services in many areas, and this is where business correspondents step in. They are playing a pivotal role in ensuring that the last mile has access to resources to tide this pandemic. The BCs are the pillars that harmonize the delivery of critical financial services like cash deposit and DBT, while risking their lives. It is thus our humble appeal to the government to ensure that the services run smoothly, and they are motivated and able to carry out their operations without any difficulty.”

The industry body also appealed to the government for financial support as these business correspondents are risking their own lives to rise to the challenge and are standing tall and feel proud to answer to this National Call of Duty. The meet also appealed to the government for relief measures for these correspondents who are struggling to keep businesses afloat among higher operation costs and low cash availability. Furthermore, the health risks involved in keeping these shops open amidst this epidemic mean they need to take adequate precautions and incur costs in terms of masks, hand sanitizers, intermittent shop sanitization to protect themselves and their customers — increasing costs further.

So, it is imperative that we have enough support system for the BC industry so that they are viable and have the motivation and resources to execute their critical role in these difficult times.

- Source – Press Release

- Published Date – March 27, 2020