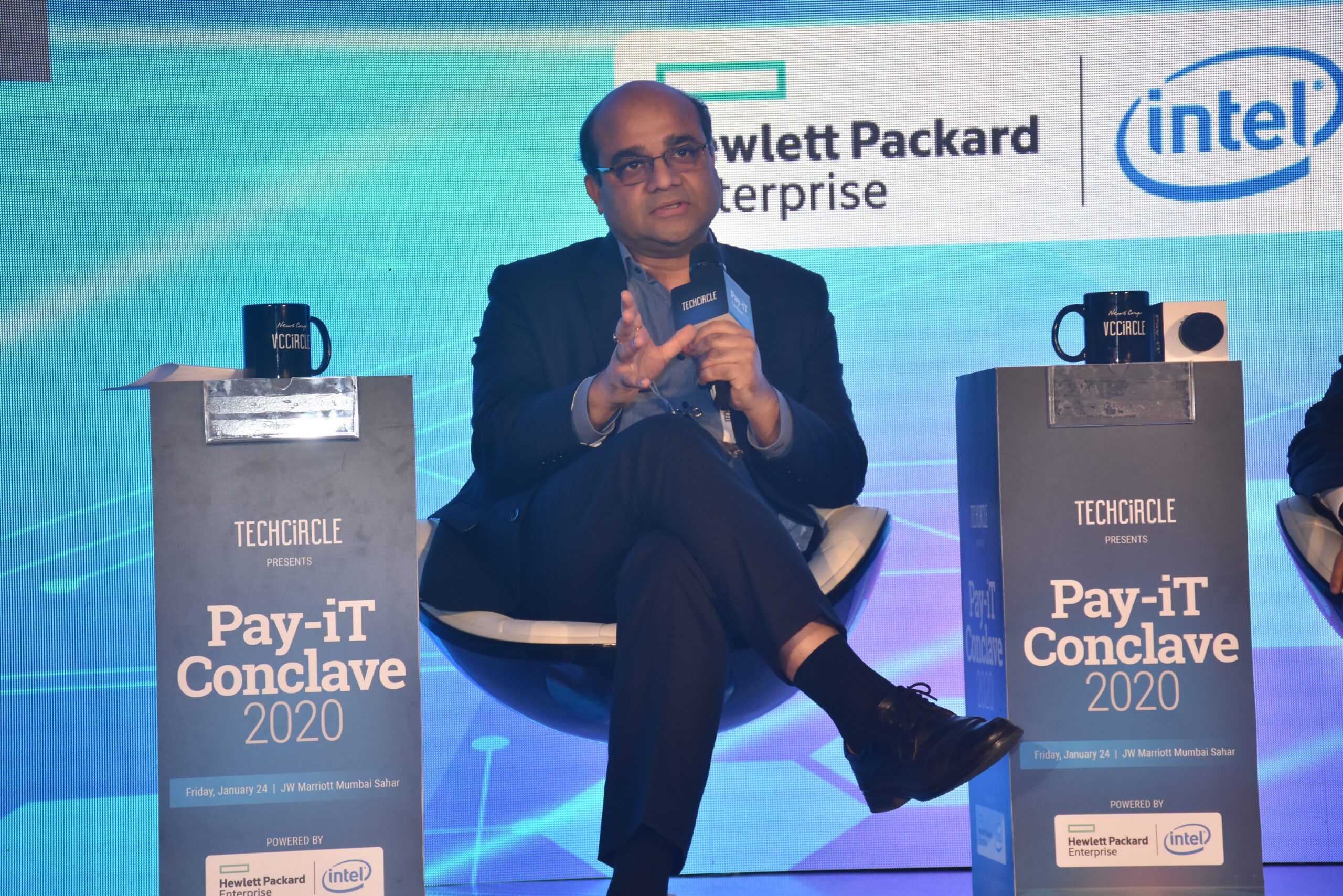

PayNearby, the hyperlocal fintech network with over 8 lakh retail touchpoints, selling financial products through the Kirana network and empowering them digitally in the process, has recently partnered with TRRAIN Circle (Trust for Retailers and Retail Associates of India) and RASCI (Retailers Association’s Skill Council of India) to reach out to 20 lakh retailers at the earliest through existing digital channels and help up-skill and certify retailers. In an exclusive interview with Point-of- Purchase, Anand Kumar Bajaj, Founder & CEO, PayNearby, discusses how the company plans to reach the target and bridge the massive digital and financial gap in India.

PayNearby began its operation in the year 2016, right? So how has been the journey so far? How did you manage to reach out to the small scale retailers?

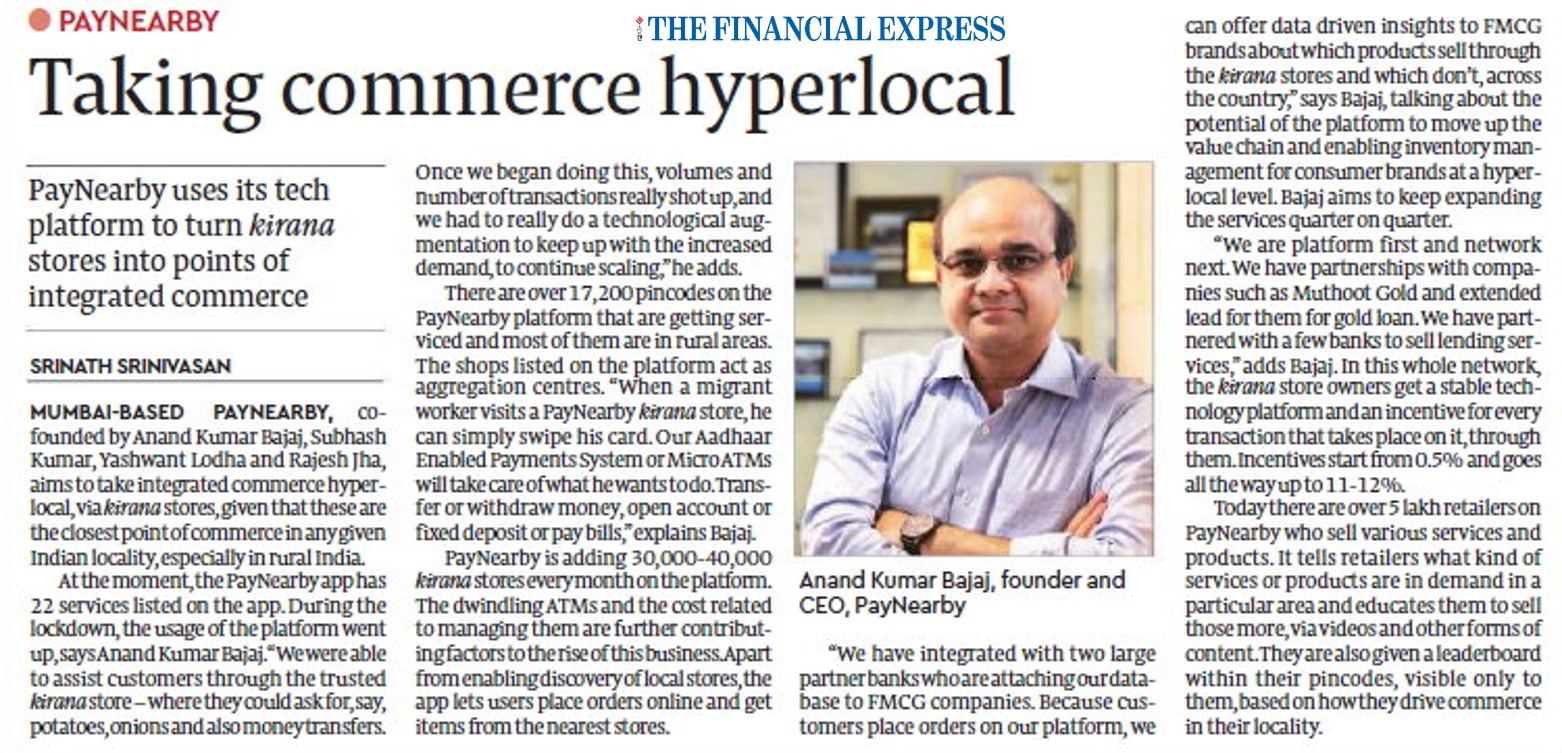

Founded in April 2016, Nearby Technologies is a fintech company offering financial/ non-financial services to the underbanked and unbanked segment. Nearby Technologies works on a B2B2C model through its various brands – PayNearby, InsureNearby, BuyNearby and few more.

It was founded by Anand Kumar Bajaj, Subhash Kumar, Yashwant Lodha & Rajesh Jha who bring with them rich experience in the field of banking, payments and other financial sectors.

(LtoR) Subhash Kumar, Rajesh Jha, Anand Kumar Bajaj, Yashwant Lodha

PayNearby is a DIPP-certified FinTech startup, partnering with various financial institutions including YES Bank, RBL Bank, ICICI Bank, State Bank of India, Axis Bank, CC Avenue, Bill Desk, NPCI, FASTag, NBFC and FMCG companies.

We have been working relentlessly towards our mission of ‘Har Dukaan Digital Pradhan’ since inception to bridge the massive digital and financial gap in India. We empower retailers at the first mile to offer digital services to local communities, thereby boosting financial inclusion in India.

How many small scale retailers are you working with currently?

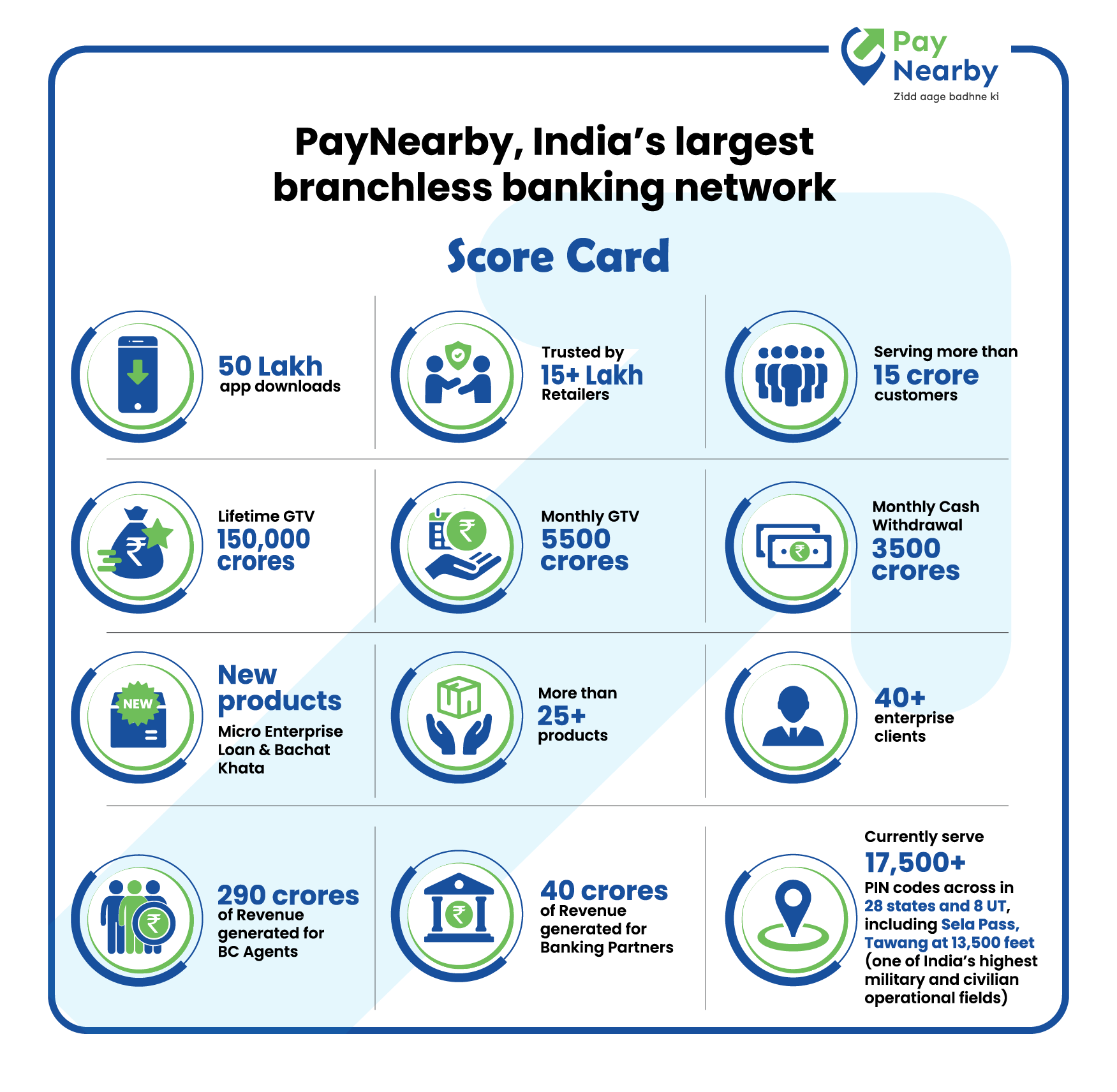

We have on-boarded about 8 lakh retailers in our last 4 years of existences. We are present in 16,772 pin codes of the 19,000 pin codes. We are able to offer our key services to the common man at the local kiranas without blocking their capitals or occupying their shelf space. Our retail partners are already credible locals in villages/ towns where they serve and our financial and other digital services are bringing additional income to our partners. We want to ‘granularize, sachetise and universalise’ the high end financial technologies through the bottom of the pyramid retailer. Soon at a retail shop, one would be able to ask for 1kg pyaaz, 2 kg aloo and Rs 100 ka insurance.

We are looking at our retail partners as a frontline to impact India, not only for reaching out to the masses to provide digitally assisted financial services, but to also skill them and serve the entire country through them. Through our own data collection application, we are able to see and capture the sales windows that they are using today, and we advise them on how they should display their merchandise, put up their signage/ board for better visibility, etc.

Traditional small scale retailers are not that open to technology and neither are they too tech savvy. How do you educate them? And what kind of support/ services do you provide to make them financially and technologically sound?

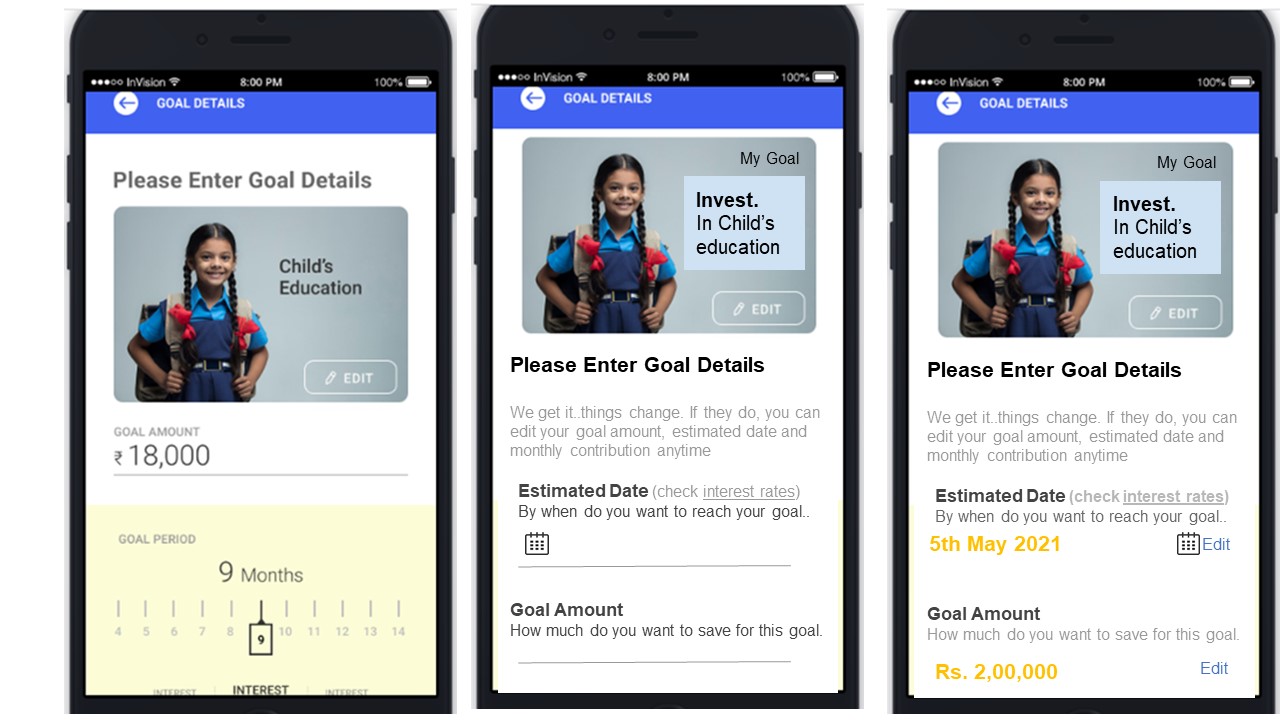

It’s not about retailers not being tech savvy. It is about improving the user experience and interface and it can be done by training them through videos and then providing the transaction screen. Eight lakh retailers have registered on our platform and are able to smoothly transition into stages of transaction and grow. Whenever a new product/services is launched, we disseminate the training videos on our app on every local language for our partners so that he is able to understand. When we on-board retailers on our platform, we do a KYC verification, PAN validation, account number validation etc to on-board him in a proper manner.

You have recently partnered with TRRAIN and RASCI to digitally up-skill and certify the retailers. What was the main objective of these two partnerships? How are you planning to achieve that target of up-skilling 20 lakh retailers by 2020?

Collaborating with TRRAIN Circle is another milestone in the journey, as it will ensure that retailers at the first mile up-skill themselves and are able to deliver the financial products seamlessly to the customers at the last mile. The partnership will enable e-learning videos along with a slew of skilling and knowledge-building courses, including financial and insurance planning and career guidance to the PayNearby retailers. Additionally, the platform will also promote holistic well-being by hosting in-house counselling for the retailers.

And to further ensure continued up-skilling and recognition of retailers we have also joined hands with the Retailers Association’s Skill Council of India (RASCI) to certify retailers for Individual Sales Professional / Self Employed, Retailer and Distributor Salesman job roles. We wish to reach out to 20 lakh retailers at the earliest through existing digital channels and help up-skill and certify the retailers.

How do you monetize your services that you provide to the small scale retailers?

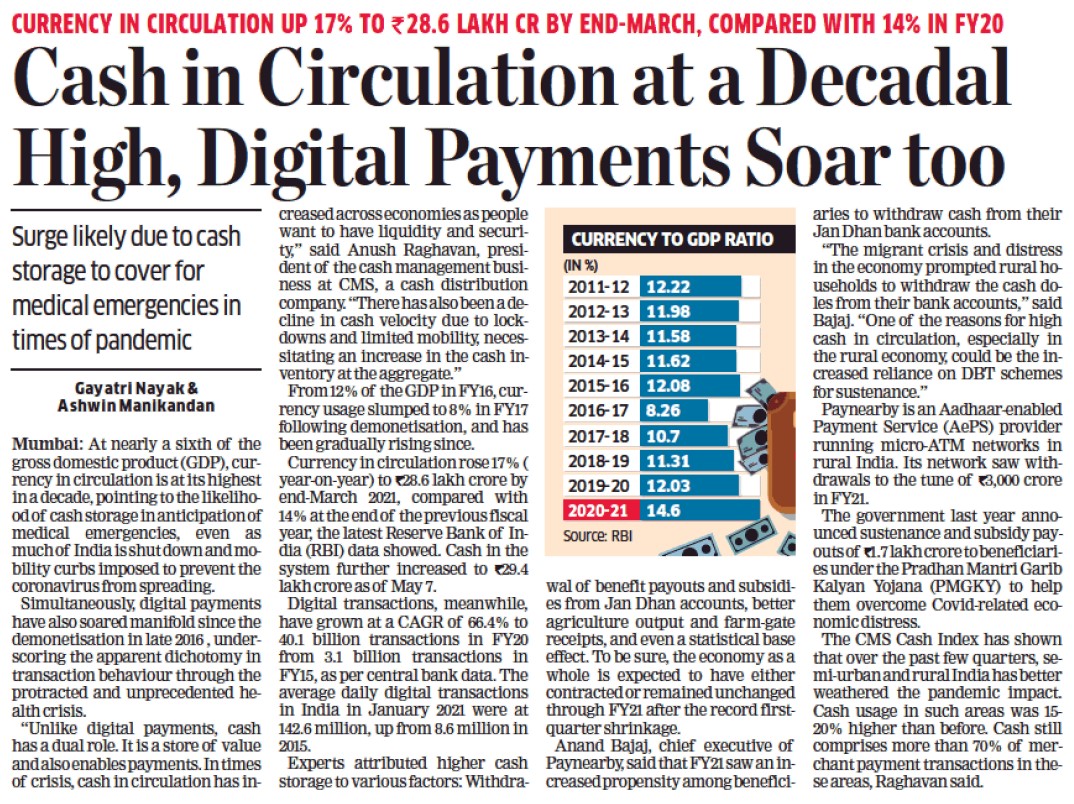

If you look at migrants who come to urban centre, he or she has 2 choices – wait in the bank for 2-3 hours to send money to his family and thereby waive the Rs 500 interest, or walk up to kirana stores, our partners, and pay Rs 20 to send Rs 2000 home. 62% of our transactions happen beyond banking hours, before 8 am and after 4 pm. That means the consumer is able to appreciate our service and is willing to pay Rs 20 for a Rs 2000 remittance to his family and save his entire day. Likewise when we disseminate Aadhar-based withdrawals to our customer, their banks pay us money because we have served their customers. Likewise when we do a mobile recharge or railway tickets or if we sell an insurance, there is a fee that we generate. This is a small margin, but the segments are willing to pay.

- Source – Retail 4 Growth - Point-of-Purchase Magazine

- Published Date – February 6, 2020