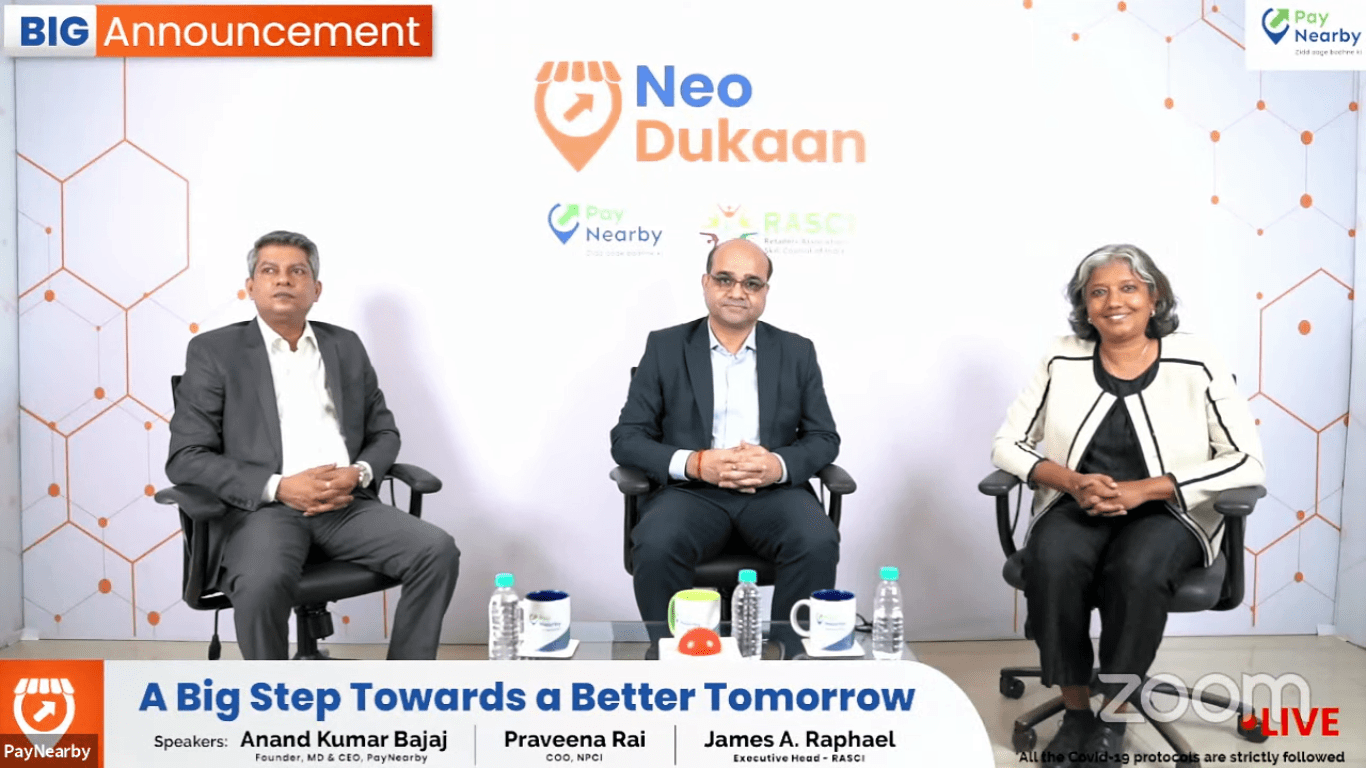

(LtoR James A. Raphael, Anand Kumar Bajaj, Praveena Rai)

One-stop-shop platform empowering retailers to modernize trade and accelerate digital adoption

Aims to offer host of tech-enabled trade offerings to drive mass acceptance

To offer an all-inclusive digital payment hub that ensures easy acceptance across different form factors, simplified for both retailers and customers

A store management tool to offer one-click process to take stores online, digital ledger for better credit management and unified platform offering wholesale procurement options

Eyes to digitize millions of largely underserved MSMEs as well as bring a new set of retailers into the PayNearby fold

In its bid to mass modernize the retail sector across the country, PayNearby, India’s leading branchless banking and digital payments network, has associated with Retailers Association’s Skill Council of India (RASCI) to launch “PayNearby NeoDukaan” to digitally upgrade its retail partners and gear them towards a better livelihood. PayNearby NeoDukaan is a first-of-its-kind holistic store management tool aimed at digitizing the retail stores and accelerating digital adoption at the last mile. With multiple digital payment options, digital ledger for credit management and online wholesale procurement options, PayNearby NeoDukaan looks to create a thriving ecosystem for its retail partners by empowering them digitally and bringing them at par with the current times.

In India, retail is evolving, retailers are not. Retail is India’s largest industry, accounting for over 10% of the country’s GDP and 8% of employment, however, despite its large size, the sector has remained predominantly unorganized due to the presence of local stores and vendors. To win in this changing landscape, the local retailers need to change too. To be indispensable to the consumer, local retailers must constantly update to accommodate their various needs. And, PayNearby is completely transforming the retail outlets and making them future-ready. The company has enabled more than 38+ lakh retailers across 17, 600+ PIN codes to have a strong online presence and ensures that small and local shops are not left behind in the transforming digital world.

Echoing this sentiment is PayNearby’s latest business vertical – the NeoDukaan app. This store management package is an end-to-end comprehensive suite that exclusively focuses on helping retailers modernize their stores, simplify their lives and bring them at par with the times. With this app, PayNearby intends to make retailers future-proof and take them to the level where they can compete with the e-commerce giants and large format superstores. PayNearby NeoDukaan enables stores to go online with a single click and service customers in their neighborhood and beyond to avail the digital store at their convenience. With this platform, PayNearby aims to digitally empower the local retailers in India whilst enhancing their efficiency and opportunities to serve their customers better.

Today, it is crucial for all stores to have digital formats of digital payments. This all-new platform will enable retailers to offer wide-ranging payment options such as UPI QR, Aadhaar Pay, mPOS and SoftPOS to the customers in the local community. Besides being cost-effective and easily implementable, retailers will not lose customers due to limited payment options and will be able to offer digital financial services seamlessly. PayNearby NeoDukaan will help retailers provide a slew of choices to their customers and will help accelerate digital adoption in the country, especially among the underbanked spectrum, reducing the demand for cash and cash-led transactions. Besides, in the wake of COVID, it will enable customers to make safe, contactless payments too. NeoDukaan, thus, aims to democratize digital payments, ensuring the availability of form factor agnostic transactions at the last mile such that digital payments become as seamless as exchanging cash.

In the majority of Tier II, Tier III cities and beyond, most of the daily businesses run on credit. Retailers end up breaking their backs to maintain a physical ledger and spending long hours on reconciliation. While retailers are used to traditional bookkeeping by maintaining bahi-khatas, NeoDukaan will help them manage customer credits more efficiently with ‘Customer Khata’ – a digital ledger. Besides offering enhanced security, Customer Khata will help retailers to go digital, streamline their accounts and reconcile better. With Customer Khata, retailers can record all transactions digitally, set automatic payment reminders for customers – so that they can collect the dues on time, and view customized reports too.

Moreover, many small businesses do not have a good supply management. They often end up shelling out exorbitant prices for supplies that are way beyond the wholesale rates, incurring losses. To help with this, PayNearby NeoDukaan will also function as an aggregator platform, whereby retailers can easily access various wholesale procurement alternatives such as Big Basket, ITC, Unnati etc. all in one spot. Currently, no other player offers multiple wholesale procurement options on a unified platform. Besides operational efficiency, the app will enable retailers to digitally procure goods timely and at competitive prices.

Commenting on this occasion, Mr. Anand Kumar Bajaj, Founder, MD & CEO, PayNearby, remarked, “We are thrilled to present the PayNearby NeoDukaan app to help our retail partners grow non-stop in life. Retailing in India is one of the pillars of our socio-economic structure, with retailers having deep-rooted relationships in the local communities. For India to thrive and grow, it is important that the retailers are given the necessary support and tools to stay relevant in the fast-evolving economy. PayNearby NeoDukaan is one such effort committed to enabling financial inclusiveness and the economic wellbeing of the retailers.

As the word ‘neo’ denotes transformation, PayNearby NeoDukaan will be a game-changer for the mass retail community offering them opportunities to acquire new customers, engage better with existing customers and reduce the cost of operations. This will further accelerate the growth of the digital economy even across hinterlands and remote towns whilst making ‘Digital India’ a closer reality. PayNearby NeoDukaan will transform every shop in the country into a shop ready for a new era.

As an organization, PayNearby acknowledges the deep symbiotic relationship it has with the retailer community, and with PayNearby NeoDukaan, we want to assure the progress of our retailers. Our association with RASCI will ensure that our retail partners have all they need to get ahead in life. This is our ‘Zidd Aage Badhne Ki’. A ‘Zidd’ to make every shop in Bharat modern, digitally-empowered and future-ready.”

On the occasion, James A. Raphael Executive Head – Retailers Association’s Skill Council of India (RASCI) and Joint Central Apprenticeship Adviser – Ministry of Skill Development & Entrepreneurship (GOI) said, “PayNearby is paving the way to bridge the gulf of Bharat and India. NeoDukaan is a committed stride towards the digital empowerment of local retail at the last mile. It will position Indian retailers at the forefront of a new consumption economy whilst offering a huge stimulus to the ‘Digital India’ movement. This digital transition will usher in a new era of commerce, transform ‘job seekers’ into ‘job creators’ and will create millions of livelihood opportunities in the hinterlands and small towns thereby driving economic growth and social upliftment in the real Bharat.”

Additionally, the company has set an ambitious target of onboarding 100 million retailers by 2025. PayNearby NeoDukaan is designed to bring a completely new set of retailers into the PayNearby fold.

About PayNearby:

Incepted in April 2016, PayNearby is a fintech company creating technology and distribution network to reach financial/non-financial services to India and Bharat both. PayNearby empowers retail shop owners to offer digital services to local communities, thereby boosting digital financial inclusion. Retailer services are focused on Agent Banking, Digital payments, microSavings, microInsurance, Loan enablement among others.

It was founded by Anand Kumar Bajaj, Subhash Kumar, Yashwant Lodha & Rajesh Jha who bring with them rich experience in the field of banking, payments and other financial sectors. PayNearby is a DIPP-certified FinTech startup, partnering with various financial institutions including YES Bank, RBL Bank, IndusInd Bank, SBM Bank India, Equitas SFB, Ujjivan SFB, Axis Bank, ICICI Bank, State Bank of India, CC Avenue, Bill Desk, NPCI, FASTag, NBFC and FMCG companies. It is the sole technology provider using Aadhaar Enabled Payment Services (AEPS) and IMPS to YES Bank, making them one of the only two fintech companies hosted by the National Payments Corporation of India (NPCI).

For more details, contact:

Siva Subramanian

PayNearby

M: +91 9820848303

E: siva.subramanian@paynearby.in