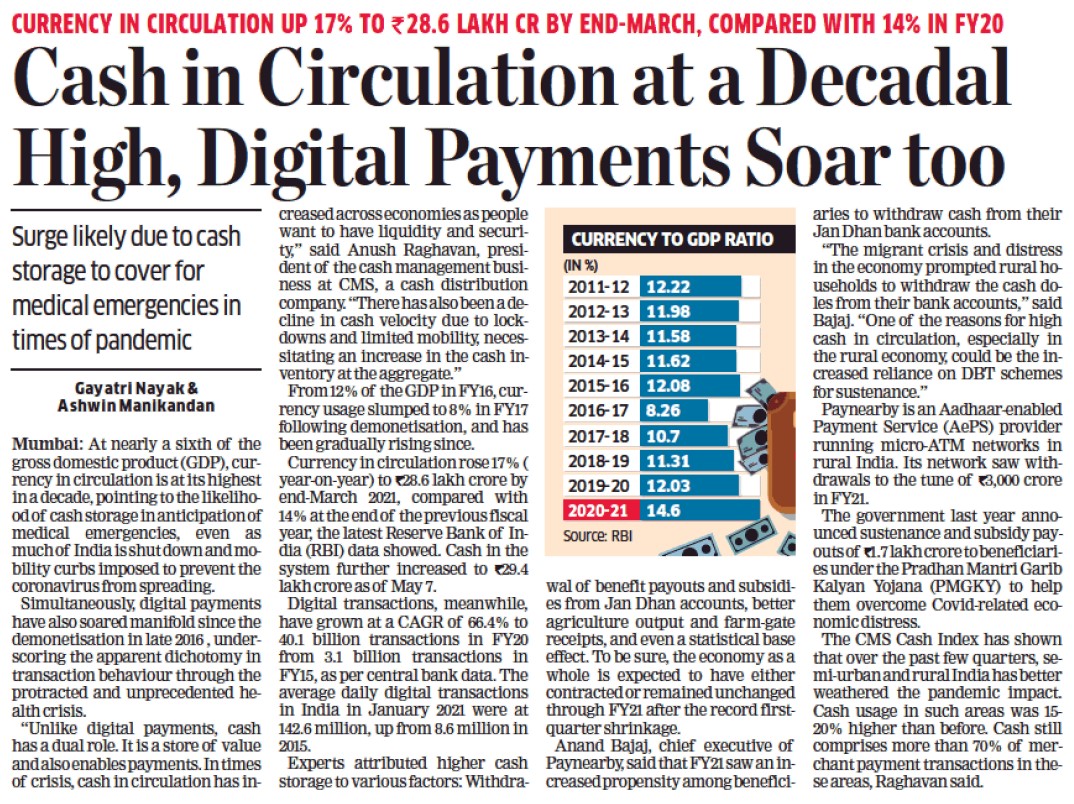

- Data from Reserve Bank of India (RBI) showed that cash withdrawals automated teller machines (ATMs) declined by 47% to 286 million in April

MUMBAI: Alternate channels of cash withdrawals like Aadhaar-enabled Payment System (AePS) and point of sale (PoS) terminals grew faster during the lockdown than traditional ATMs, latest RBI data showed.

Data from Reserve Bank of India (RBI) showed that cash withdrawals automated teller machines (ATMs) declined by 47% to 286 million in April. At the same time withdrawals from AePS more than doubled to 87 million. That apart, cash withdrawal volumes at PoS terminals grew 21% between March and April to 4 million as customers wary of the spread of covid-19, from using a public ATM, restricted themselves to a more controlled environment as housing societies arranged for cash withdrawals at doorstep.

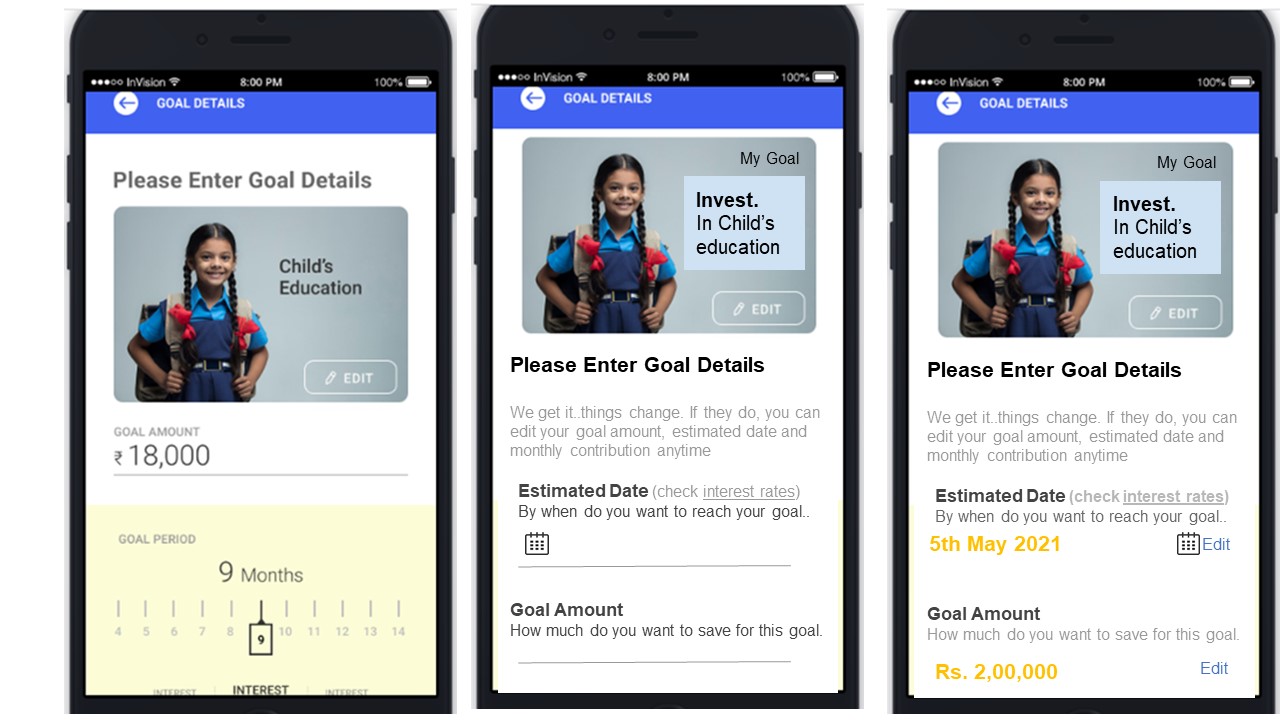

To be sure, the rise in alternate cash channels are from a lower base as compared to ATMs, a more mature withdrawal system. AePS also found favour in cash being pulled out from Jan Dhan bank accounts when the government’s direct benefit transfer (DBT).

Fino Payments Bank has seen transactions on their business correspondent network through around 8,000 outlets of Bharat Petroleum Corporation Ltd (BPCL), which is also a strategic investor in the bank.

According to Rishi Gupta, chief executive, Fino Payments Bank, while transactions through these outlets declined in the first 15 days of the lockdown, it has gradually picked up ever since.

“Roughly about 5-7% of our transactions happens through BPCL outlets. The numbers declined in the first 15 days of the lockdown because many of these outlets were shut but it has now recovered and is back to pre-lockdown numbers in May and we expect it to grow about 20-25% in June,” said Gupta.

The RBI data also showed that India’s total digital payment volumes declined to 2.36 billion in April, from 3 billion in March. Amitabh Kant, chief executive of government think-tank Niti Aayog recently said that India is targeting one billion digital transactions per day in a push towards bringing more people under the ambit of such modes of payments.

“From three billion transactions in a month we are targeting a billion transactions per day and we are pushing for it,” Kant said on 12 June, speaking through video-conference at CII’s fintech and digitisation seminar.

The covid-19 lockdown that began on 25 March had led to a fall in digital payment volumes as e-commerce portals stopped taking orders and customer spending at large retail outlets dropped.

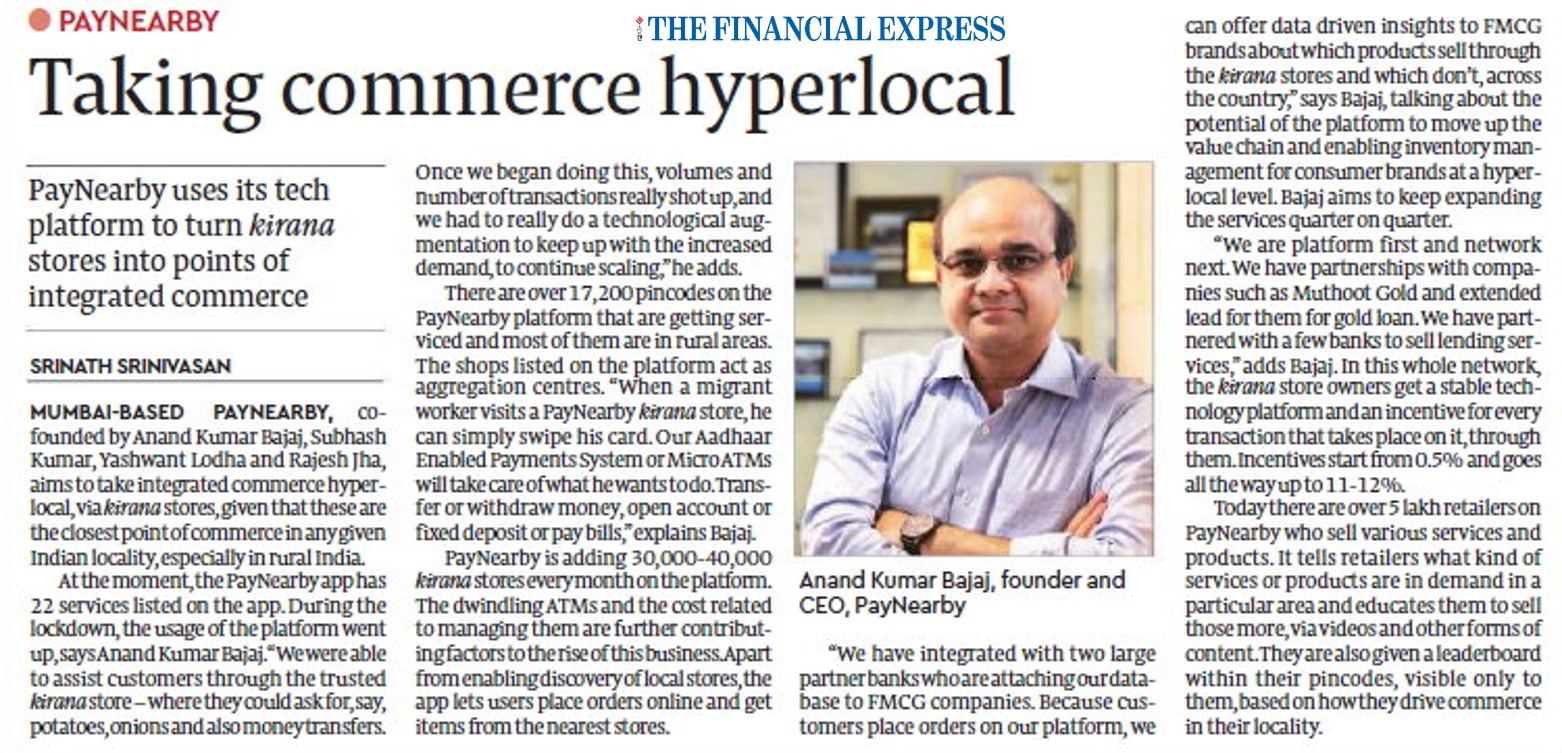

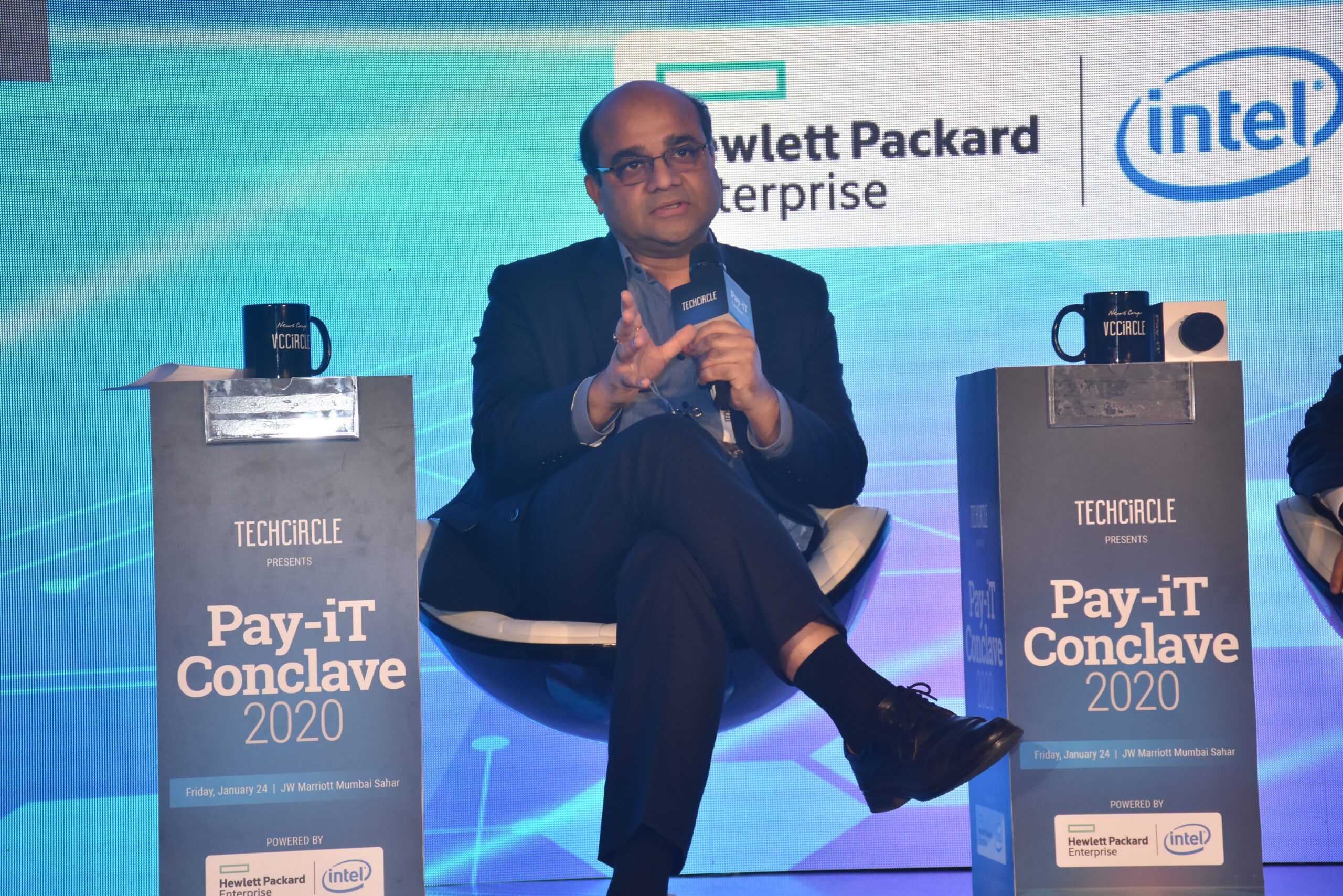

“I believe ATMs will innovate, keeping the public health angle in mind and evolve quickly. QR code-based cash-out at ATM, will have to come up faster. People have stayed away from ATMs to some extent because they did not want to use those services where the risk perception was high,” said Anand Kumar Bajaj, chief executive of PayNearby.

Bajaj added that there was sudden clamp on trade and consumption during the lockdown and people were spending mainly on essentials and groceries during that period.

“Therefore, people’s need to go to ATMs for cash declined,” he said.

Meanwhile, RBI has now started providing daily data on select payment systems. It showed that ATM cash withdrawals averaged at 10.2 million on a daily basis between 1-14 June.

According to Navroze Dastur, managing director, NCR India, April was the primetime of the lockdown and movements were significantly restricted.

“We saw a drop of about 60% in ATM transactions because people were not going out to withdraw cash. In May and June, ATM transactions have again started picking up, while it has not reached the pre-pandemic levels,” said Dastur.

- Source – LiveMint

- Author – Shayan Ghosh

- Published Date – June 15, 2020