Almost four years after a shock crackdown on cash accelerated the adoption of digital payments, the use of banknotes has jumped during the virus outbreak with many kiranas, the only ones open for business during the lockdown, insisting that customers pay in cash.

While many small retailers started accepting digital payments after the sudden invalidation of high-value currency notes in November 2016, many of the store owners have little choice but to seek cash from customers as their suppliers are demanding payments in paper money.

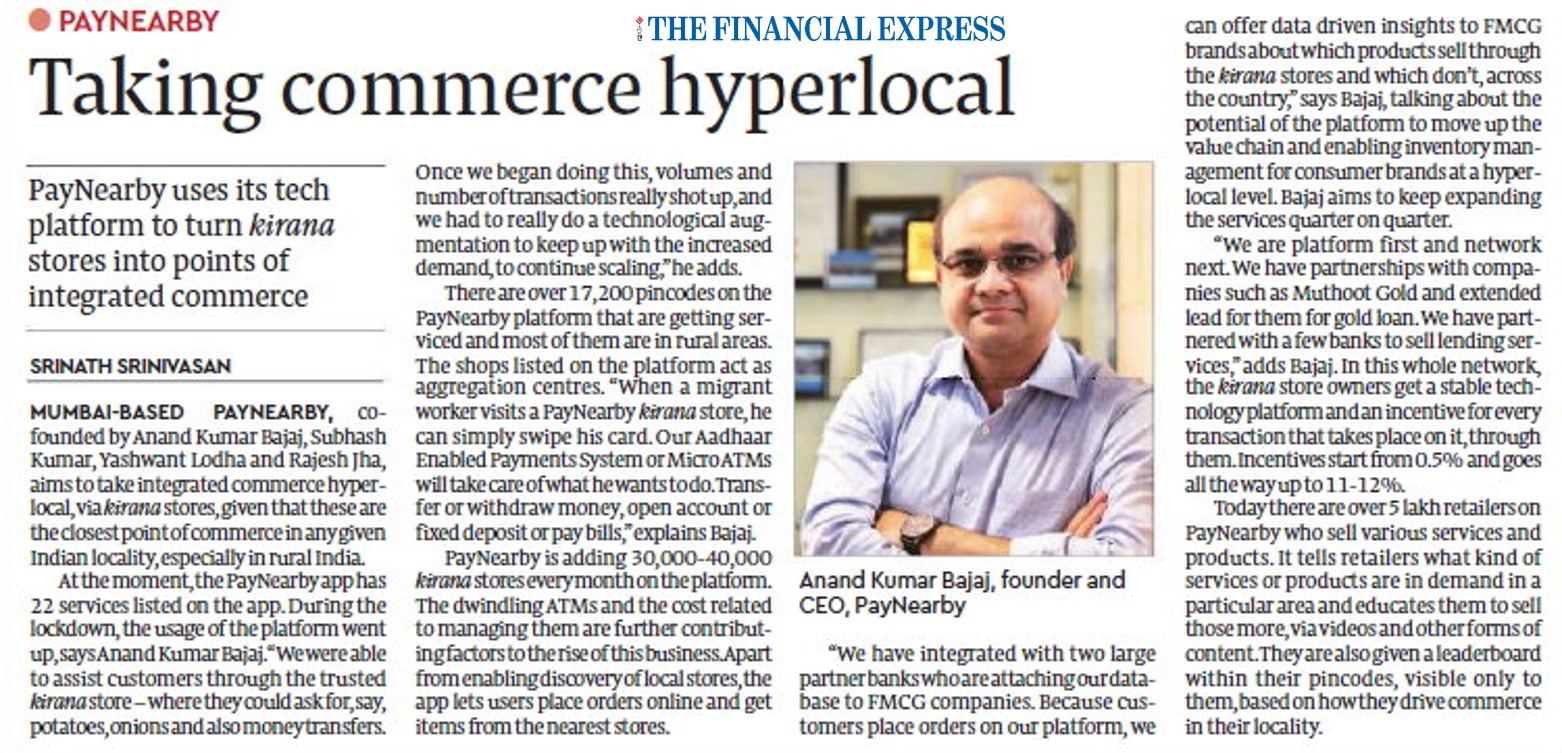

“In my area in Powai (a Mumbai suburb), several shops do not accept digital payments, citing the demand for cash from their suppliers. During the lockdown, getting cash has become difficult as people don’t want to use ATMs for want of sanitization after each use,” said Anand Kumar Bajaj, CEO of PayNearby, a digital payments company.

According to Bajaj, since a retailer is selling multiple categories of products—branded and unbranded— he has little incentive to create a behavioural change by accepting digital payments from customers since some of his suppliers are asking for cash.

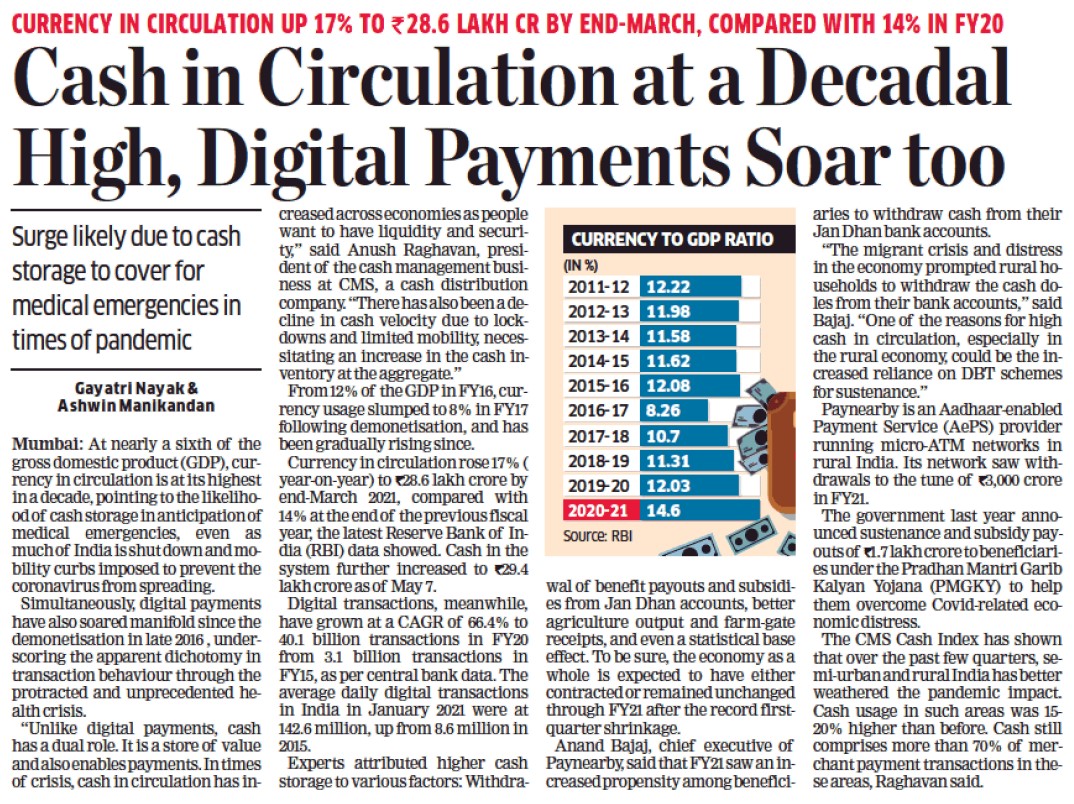

A look at the digital payments data for April paints a dismal picture as all but Aadhaar-enabled payments system (AePS) have seen volumes crash. Take the case of national electronic fund transfer (NEFT) where both inward and outward remittances have shrunk 33% between March and April to 175.9 million.

Volumes on immediate payment service (IMPS) have also declined 44% in the same period to 122.47 million transactions. Unified Payments Interface (UPI), used by some merchants, have seen a dip in volumes to 999.57 million in April from 1.24 billion in the preceding month.

Meanwhile, the cash in circulation in the economy has risen by 3.6% to ₹25.35 trillion in the first month of this fiscal year, showed RBI data.

- Source – Mint

- Published Date – May 11, 2020